“I’m Mad as Hell and Not Going to Take it Anymore!”

I think you’ll agree with me when I say that bad things mostly happen when the perpetrators don’t think others will find out about it. We’re lucky we live in a country which makes a “thing” out of freedom of speech. Our media is free to say whatever they like and so are we. Some think we err on the side of too much freedom of speech and too much media. Even though I might agree, I’d rather have too much than too little.

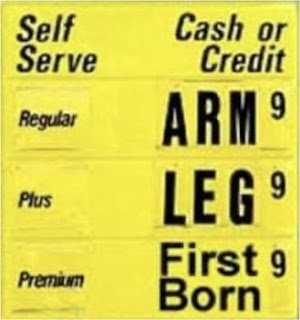

I’ve been a car dealer for over half a century, and I can tell you that dealers’ lack of ethics and their preponderance of dishonesty hasn’t changed much since 1968. The Gallup Annual Poll on Honesty and Ethics in Professions backs me up on this, https://news.gallup.com/poll/388649/military-brass-judges-among-professions-new-image-lows.aspx. Car dealers have ranked at the bottom of this list since the first survey in 1977!

Sadly, bad behavior by car dealers isn’t trending any better for a variety of reasons. When bad behavior is readily allowed and unregulated for a long period of time it becomes the status quo. It has inertia…the tendency of an object in motion, to remain in motion. Think of driving on the typical expressway. No matter what the posted speed, the actual flow of traffic is at least 10 mph faster. Why? That’s for two reasons. The first is that every driver knows that they can “get away with” driving 10 mph over the speed limit. The second is that it’s somewhat dangerous to drive at or below the speed limit. All the other drivers will pass you, blow their horn, or nearly “rear-end” you. How many cars have you bought in your lifetime? How many of those purchases were a pleasant experience? If the Gallup poll is accurate, probably none of them.

This happens because our laws against false advertising and unfair and deceptive trade practices aren’t enforced. They’re not enforced because of the powerful lobbying influence of car dealers. It’s no coincidence that “lobbyists” sit at the bottom of the Gallup poll with car dealers. Almost all dealers are guilty of this bad behavior for the same reason that almost all motorist’s speed. If a car dealer did obey the laws when his competitors didn’t, he couldn’t effectively compete and eventually he’d be forced out of business.

The only way I know to change things is get the attention of our legislators and regulators by arousing the car-buyers who are also VOTERS. There’s only one thing that can influence a politician or a regulator more than a lobbyist with fat pockets for supporting their reelection. That’s you, the voter. Almost all voters have bought cars and most likely had nothing but bad experiences. We need to begin talking about this more. Here are some suggestions:

- Call or text my weekly radio show, Earl on Cars. You can stream the show on Facebook or YouTube, www.Facebook.com/EarlOnCars or www.YouTube.com/EarlOnCars. You can call the show at 800 960-9960 any Saturday morning between 8 and 10 EST.

- File your complaints against car dealers with your state’s attorney general or department of motor vehicles.

- Contact your local media, especially those who feature consumers’ advocate journalists.

- Check out this website, www.Markups.org. This is a new website that allows you to report your car dealers’ markups above MSRP and post a picture of their addendum label. I just learned about this and posted a $5,000 window sticker addendum used by Wallace Cadillac in Stuart, FL, https://markups.org/Cadillac/wallace-cadillac.html.

I think another reason why car dealers have been able to operate for so long “in the shadows” is that many car buyers don’t like to admit that they’ve been taken advantage of. We all want to believe that we made a good buy and, maybe even more importantly, we want our friends and neighbors to think so. By “shining the cold light of day” on car dealers’ bad behavior, more people will realize their friends and neighbors were also “screwed” and are also remaining silent.

Please help me end the silence.