I consider myself pretty good with words, but I cannot fully express how happy Nancy and I are to be back on the air assisting you and all South Floridians with their car buying and servicing issues. We answered all of your questions for seven years from our live, one-hour talk show on Seaview Radio, but had to take a thirteen month hiatus from November 2013.

You can tune us in any Tuesday afternoon from 4pm to 6pm on JVC Broadcasting’s, “900 The Talk of the Palm Beaches”. That’s 900 on your AM dial. Our first show is Tuesday, December 16 and if you read this blog in time, we encourage you to listen and call the show with your comments and questions. You can stream the show live by following this link Stream Earl & Nancy LIVE.Our show is live, but it will be recorded for replay on Sundays from also from 4 PM to 6 PM. I’m excited to say that our show will also be simulcast live in Long Island, NY on 103.9, LI News Radio. Nancy and I will be off the air for the holidays, Christmas Eve and New Year’s Eve, but back on again Tuesday, January 7.

Nancy and I would like to thank the new owners of Seaview Radio, John Caracciolo, and Vic Canales for allowing former Seaview and current JVC General Manager, Chet Tart, to reinstate our show and expand the hours and frequency. But wait there’s more! “900: The Talk of the Palm Beaches” has ten times the power of our old Seaview station. The new signal for Earl Stewart on Cars reaches north to Vero Beach, south to Pompano, and west to Ft. Myers. We will reach, literally hundreds of thousands more listeners!

Furthermore, we are adding an entire new dimension to our show with Rick Kearney, a Certified Diagnostic Master Auto Technician. Rick knows “everything” about the mechanics of automobiles. He can answer all of your questions about problems you have with your car or truck, how to be avoid being ripped off by a mechanic or service department, and how best to economically service your vehicle.

For those of you who have not listened to our radio show in the past, we offer something similar to this blog and newspaper column, but more and “live” so that you can call us and answer all of your questions. You may be in the process of buying a used or new car and need advice on how to find the lowest price, what makes and models are best for you, or which car dealers can you trust the most. You may have already bought a car and would like to share your purchasing experience, good or bad, with Nancy, me, and our radio audience. You might wonder if those “extra services” that the person you take your car to are really needed or if the price they are charging you is fair.

Someone once said that buying and servicing a car is like having a root canal without the anesthetic. We would like to offer you some advice that will not only act as an anesthetic, but actually turn the buying an servicing of cars into a pleasurable experience. If you listen to Earl Stewart on Cars, you will hear me quote Jim Press, the former CEO for Toyota for all of North America and the first non-Japanese to sit on Toyota’s board of directors, “The way you treat the customer when you do not owe them anything, like how you treat somebody who cannot fight back—that is the ultimate test of character.” This sums up Nancy’s and my ultimate goal which is to ensure that all car dealers and service departments in South Florida understand the truth of this statement.

Important Links

Just Added: New link to Florida AG!

Monday, December 15, 2014

Monday, December 08, 2014

Dealing With the Dealer Fee - Earl Stewart's User Guide

Hopefully by now, all but my newest readers know about the infamous “Dealer Fee”. If you don’t know, it’s a hidden price increase on the car you purchase disguised to look like a federal, state, or local tax or fee. It’s actually 100% profit to the dealer. “Dealer Fee” is the most common name for this disguised profit, but it goes by many names such as doc fee, dealer prep fee, service fee, administrative fee, electronic filing fee, e-filing fee, tag agency fee, pre-delivery fee, etc. The names are only limited by car dealers’ imaginations. Almost all car dealers in Florida charge a Dealer Fee. The dealer fees range from around $700 to as high as $2,000!

This is the Florida law that is supposed to regulate the Dealer Fee: “The advertised price must include all fees or charges that the customer must pay excluding state and local taxes.” The law also requires that the Dealer Fee must be disclosed to the buyer as follows: “This charge represents costs and profits to the dealer for items such as inspecting, cleaning, and adjusting vehicles and preparing documents related to the sale.”

This law is very weak and almost never enforced. When enforced, it isn’t enforced by the letter of the law; it is done so as to “accommodate” the car dealers. The law is “weak” because it requires only that the dealer fee be included in the “advertised” price. The word “advertised” is narrowly interpreted to mean a specific car shown in a newspaper, TV, radio, or online ad, but, what about when you get a price on the phone, online, or from the salesman? You don’t find out about the Dealer Fee until you’re in the business office signing a bunch of papers. The dealers get around advertisements very easily by including a “number” in the fine print. This number is their stock number that designates one specific car. When you respond to the ad, this car is no longer available (sales people are usually not paid a commission for selling the “ad car). The advertisement might say “many more identical cars are available.” It’s true that identical cars are available for sale, but they are not available for sale at the sale price because they are not the advertised stock number car. If you buy one of those “exact same cars” you will pay from $700 to $2,000 more.

The reason I’m told that the law is rarely enforced is that the Florida Attorney General’s office is understaffed and too busy enforcing other Florida laws. I’m also told that Florida car buyers don’t file very many complaints against car dealers for violating the Dealer Fee law. I don’t believe that there can be too many other infractions of the law that take more money annually from consumers than dealer fees take from car buyers. Just one car dealer selling 1,000 cars a year and charging a $1,000 dealer fee is taking a $1 million annually from car buyers. Most car dealers in South Florida well a lot more than 1,000 cars annually and many charge more than $1,000 dealer fee. I believe that the reason more complaints aren’t filed on the dealer fee is because most car buyers don’t know that they are being duped. They either don’t notice the fee or assume it’s an official federal or state fee. Dealer often tell their customers that all dealers charge it and that it’s required by law.

The Attorney General also “accommodates” the dealers by not interpreting the law the way it was intended. For example, the law says that the dealer fee must be included in the advertised price. The Florida Senate has ruled that the law requires that the fee be “included” rather than “specifically delineated.” But the Attorney General allows car dealers to advertise car prices without including their dealer fee in the price if they mention their dealer fee in the fine print. They also allow car dealers to simply state in the fine print that they have a Dealer Fee but not even mention the amount. To me they are simply allowing the car dealers to break the law.

Lastly, the required disclosure of the Dealer Fee on the vehicle buyer’s order or invoice is confusing, misleading, and incorrect: “This charge represents costs and profits to the dealer for items such as inspecting, cleaning, and adjusting vehicles and preparing documents related to the sale.” It should not say “costs” because any cost that you pass along to the customer in the price of a product is pure profit. A dealer can pass along his utility bills, sales commissions and advertising if he wants to and call it a “dealer fee”. It should not say “inspecting, cleaning, and adjusting vehicles” because all car dealers are reimbursed by the manufacturer for “inspecting, cleaning, and adjusting vehicles”.

So, what should you do when you are confronted by a car dealer with the “Dealer Fee”? Besides “LEAVE”, here are some suggestions that may help you:

(1) Make it clear from the very beginning that all prices you discuss must be “out-the-door” prices. This way you don’t care if the dealer fee added up front because you will shop and compare their bottom line price with at least 3 competing car dealers. Ideally you should require that they include tax and tag in that price. If you don’t they might try to slip in something they call the “electronic filing fee” or “e filing fee” and trick you into believing it’s part of the license tag and registration.

(2) The dealer will often tell you that all car dealers charge Dealer Fees and that they are required by law to add the dealer fee on every car they sell. Simply tell them that you know this is not true and you can cite me and other car dealers like Mullinax Ford who do not charge a dealer fee. Print out a copy of this article, show it to them, and tell them that you know that there is no law that says he must charge you a dealer fee.

(3) As long as you and the dealer understand that the out-the-door price is the price you will shop and compare with his competition, you don’t need to be concerned whether there is a dealer fee showing on the vehicle buyer’s order. To be competitive, the dealer can simply reduce the price by the amount of his Dealer Fee and the bottom line is what you are comparing.

(4) Be aware that dealers usually do not pay their sales people a commission on the amount of their dealer fee. In fact, dealers often misinform their sales people just like they do their customers. The salesman who tells you that the all dealers charge Dealer Fees and that the law requires everyone pay a dealer fee may actually believe it. Sale people who understand that the Dealer Fee is simply profit to the dealer will be resentful of not being paid their 25% commission on it. A $1,000 dealer fee costs the salesman $250 in commission.

(5) When you respond to an advertisement at a specific price for a specific model car, object when the dealer adds the dealer fee. Unfortunately, the law allows him the loophole of claiming that the ad car is a different stock number, but you might be able to shame him into taking off the dealer fee. If you raise a “big enough stink”, the dealer would be smart to take off the dealer fee than claim that technicality, especially if you were to advise the local TV station or newspaper.

I hope that these suggestions help you and I hope that you will file a complaint with the Florida Attorney General, Pam Bondi. If enough consumers (who are also voters) let our elected officials know how they feel about the Dealer Fee, it will bring positive results.

This is the Florida law that is supposed to regulate the Dealer Fee: “The advertised price must include all fees or charges that the customer must pay excluding state and local taxes.” The law also requires that the Dealer Fee must be disclosed to the buyer as follows: “This charge represents costs and profits to the dealer for items such as inspecting, cleaning, and adjusting vehicles and preparing documents related to the sale.”

This law is very weak and almost never enforced. When enforced, it isn’t enforced by the letter of the law; it is done so as to “accommodate” the car dealers. The law is “weak” because it requires only that the dealer fee be included in the “advertised” price. The word “advertised” is narrowly interpreted to mean a specific car shown in a newspaper, TV, radio, or online ad, but, what about when you get a price on the phone, online, or from the salesman? You don’t find out about the Dealer Fee until you’re in the business office signing a bunch of papers. The dealers get around advertisements very easily by including a “number” in the fine print. This number is their stock number that designates one specific car. When you respond to the ad, this car is no longer available (sales people are usually not paid a commission for selling the “ad car). The advertisement might say “many more identical cars are available.” It’s true that identical cars are available for sale, but they are not available for sale at the sale price because they are not the advertised stock number car. If you buy one of those “exact same cars” you will pay from $700 to $2,000 more.

The reason I’m told that the law is rarely enforced is that the Florida Attorney General’s office is understaffed and too busy enforcing other Florida laws. I’m also told that Florida car buyers don’t file very many complaints against car dealers for violating the Dealer Fee law. I don’t believe that there can be too many other infractions of the law that take more money annually from consumers than dealer fees take from car buyers. Just one car dealer selling 1,000 cars a year and charging a $1,000 dealer fee is taking a $1 million annually from car buyers. Most car dealers in South Florida well a lot more than 1,000 cars annually and many charge more than $1,000 dealer fee. I believe that the reason more complaints aren’t filed on the dealer fee is because most car buyers don’t know that they are being duped. They either don’t notice the fee or assume it’s an official federal or state fee. Dealer often tell their customers that all dealers charge it and that it’s required by law.

The Attorney General also “accommodates” the dealers by not interpreting the law the way it was intended. For example, the law says that the dealer fee must be included in the advertised price. The Florida Senate has ruled that the law requires that the fee be “included” rather than “specifically delineated.” But the Attorney General allows car dealers to advertise car prices without including their dealer fee in the price if they mention their dealer fee in the fine print. They also allow car dealers to simply state in the fine print that they have a Dealer Fee but not even mention the amount. To me they are simply allowing the car dealers to break the law.

Lastly, the required disclosure of the Dealer Fee on the vehicle buyer’s order or invoice is confusing, misleading, and incorrect: “This charge represents costs and profits to the dealer for items such as inspecting, cleaning, and adjusting vehicles and preparing documents related to the sale.” It should not say “costs” because any cost that you pass along to the customer in the price of a product is pure profit. A dealer can pass along his utility bills, sales commissions and advertising if he wants to and call it a “dealer fee”. It should not say “inspecting, cleaning, and adjusting vehicles” because all car dealers are reimbursed by the manufacturer for “inspecting, cleaning, and adjusting vehicles”.

So, what should you do when you are confronted by a car dealer with the “Dealer Fee”? Besides “LEAVE”, here are some suggestions that may help you:

(1) Make it clear from the very beginning that all prices you discuss must be “out-the-door” prices. This way you don’t care if the dealer fee added up front because you will shop and compare their bottom line price with at least 3 competing car dealers. Ideally you should require that they include tax and tag in that price. If you don’t they might try to slip in something they call the “electronic filing fee” or “e filing fee” and trick you into believing it’s part of the license tag and registration.

(2) The dealer will often tell you that all car dealers charge Dealer Fees and that they are required by law to add the dealer fee on every car they sell. Simply tell them that you know this is not true and you can cite me and other car dealers like Mullinax Ford who do not charge a dealer fee. Print out a copy of this article, show it to them, and tell them that you know that there is no law that says he must charge you a dealer fee.

(3) As long as you and the dealer understand that the out-the-door price is the price you will shop and compare with his competition, you don’t need to be concerned whether there is a dealer fee showing on the vehicle buyer’s order. To be competitive, the dealer can simply reduce the price by the amount of his Dealer Fee and the bottom line is what you are comparing.

(4) Be aware that dealers usually do not pay their sales people a commission on the amount of their dealer fee. In fact, dealers often misinform their sales people just like they do their customers. The salesman who tells you that the all dealers charge Dealer Fees and that the law requires everyone pay a dealer fee may actually believe it. Sale people who understand that the Dealer Fee is simply profit to the dealer will be resentful of not being paid their 25% commission on it. A $1,000 dealer fee costs the salesman $250 in commission.

(5) When you respond to an advertisement at a specific price for a specific model car, object when the dealer adds the dealer fee. Unfortunately, the law allows him the loophole of claiming that the ad car is a different stock number, but you might be able to shame him into taking off the dealer fee. If you raise a “big enough stink”, the dealer would be smart to take off the dealer fee than claim that technicality, especially if you were to advise the local TV station or newspaper.

I hope that these suggestions help you and I hope that you will file a complaint with the Florida Attorney General, Pam Bondi. If enough consumers (who are also voters) let our elected officials know how they feel about the Dealer Fee, it will bring positive results.

Monday, December 01, 2014

Don’t Fall For Nitrogen (What Car Dealers Tell You Is Nonsense)

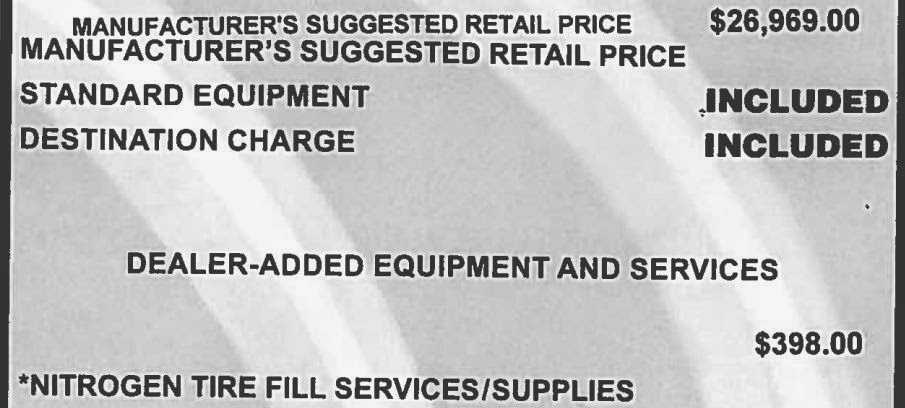

I’ve been

writing articles on why nitrogen in your tires is a waste of money for several

years, but It has had very little effect on the number of car dealers that are

selling it to their customers. The “Nitrogen Lobby” must be very powerful

because we still have no federal or state legislation to curtail this. Selling

nitrogen generation equipment and tanks of nitrogen to car dealers is very

lucrative and, even more lucrative is the money car dealers make selling

nitrogen to their customers. One large volume car dealer charges $398 for

nitrogen in the tires of every vehicle he sells. The cost of nitrogen is

about “25 cents” per application. If you feel you absolutely must have nitrogen

in your tires, Costco will give it to you “free” which is exactly what nitrogen

in your tires is worth.

I don’t

recommend that you even accept free nitrogen for this reason. It’s

widely accepted and recommended that you should have your tire pressure checked

in your tires at least monthly. We do this free for our customers and

automatically do it at every service visit. When you are sold or even given

nitrogen, it comes with a sales pitch that nitrogen will remain in your tires

for a much longer time than air which is not true. Click on this link to

Consumer Reports article, www.NitrogenInTiresWastesYourMoney.com. If you believe the sales pitch, you’re less

likely to check your tires inflation every 30 days. You may have a slow leak in

one tire from a nail or screw, uneven wear from misalignment, or even a

defective tire. Being “over confident” because you paid money for nitrogen may

cause these problems to go undetected. Consumer Reports estimates that 1lb of nitrogen will escape from your tires

every 3 months vs. 1 month for air. Remember that air is 78% nitrogen. I’ll bet

the salesman that sells you nitrogen “forgot” to tell you that.

Be prepared

for a great sales pitch on nitrogen. You’ll be told that NASCAR uses

nitrogen in the tires of their race cars, NASA used nitrogen in the tires of

their space shuttle, and that airlines uses nitrogen in airplane tires. All of

this is true, but so what? A race car going 200 mph for hours and hours around

an oval track subjects its tires to extremely high temperatures. 100% nitrogen

gas does expand less under extreme heat condition than 78% nitrogen gas (air).

The space shuttle tires go from zero atmospheric pressure in outer space to

regular pressure at sea level. Airliners also have extreme pressure variations

from 30,000 feet to the ground.

To be

perfectly fair, I must say that some car dealers that are selling nitrogen have

“drunk the Kool Ade” from the nitrogen generation equipment industry. Some car

dealers actually believe that nitrogen is good for your tires. But those

who do know must know how much they’re marking up that 25 cents worth of

nitrogen they’re selling you! The argument for nitrogen can be persuasive. In

fact, when the concept was first introduced, before the Consumer Reports study, I actually considered adding nitrogen to my

customers’ tires. But, in an abundance of caution, I decided to test the claims

about nitrogen myself. Over a six month period I used pure nitrogen in 50% of

my rental car fleet and regular air (78% nitrogen) in the other half. Guess

what! There was no measurable difference between the pure nitrogen and air

filled tires in the fuel economy, tire wear, or inflation pressure after 6

months. We did check the tires every 30 days for slow leaks from road hazards,

uneven wear from misalignment or other reasons, and we rotated and balanced the

tires every 5,000 miles.

Finally,

I’ll tell you why I was so careful to be sure there was no advantage to

nitrogen. My dealership has a “fee tire program”. Everybody who buys a Toyota

from me, new or used, receives free tires (maximum of $700 per set) for as long

as they own their car. The one requirement is that they bring their car back to

me for the factory recommended service and we replace only tires from normal

wear, not road hazards, underinflating or misalignment. I give away over

$100,000 worth of tires every month, well over a million dollars per year.

BELIEVE ME, if I thought I could get longer wear from a tire for “25 cents”

worth of nitrogen, I would! I look at the tires on my customers’ cars as

“belonging to me” because I incur the cost of replacing them when they wear

out.

Subscribe to:

Comments (Atom)