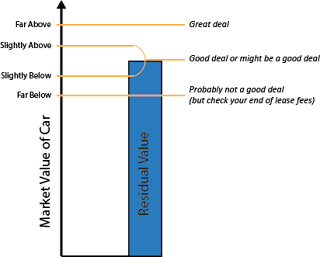

One of the advantages of leasing is your option to buy the lease car at the end of your lease at the residual price. The residual is what the leasing company “guessed” your car would be worth at the end of your lease. They guessed because nobody has a crystal ball that tells them exactly what a used car will be worth 3 or 4 years in the future. If they guessed low, you have an opportunity. If they guessed high, you have no obligation; it’s the leasing company’s problem and they have to sell the car and take a loss.

The best thing about making this decision is that you are holding the best hand in the card game between you, the leasing company, and the dealer. That is because you know your car better than they do. You probably have been driving it for close to three years, you know how well you have maintained it, how worn the tires are, whether or not it has been wrecked and repaired, and how many dings, dents, or upholstery blemishes there are. You know if it was garaged and how you carefully you drove it. You also know, better than anybody, how well it runs. All of these things determine the value of your car.

Unless you buy a new car, you cannot have as much confidence in any other used car that you may buy than your own used lease car. The only assurance that you have when you buy somebody else’s used car is their word or the dealer’s word about how it was driven and maintained. That means that if you did take very good care of your lease car, drove it carefully, kept it in a garage, waxed and washed it faithfully, and maintained it carefully it is worth more to you than anybody else because you are the only one who knows that. And you can never be sure about that for any other used car you might buy.

Given that you like your lease car and want to keep it, the next step is determine its wholesale market value. The leasing company usually is not in the business of selling cars, just leasing them. Getting rid of off-lease cars is expensive and time consuming for them. You have an advantage here too and you should be able to negotiate a good price. Remember, you know your car much better than they do. They will usually give you a price you can buy the car for without even looking at it. It doesn’t happen often but sometimes they will call you first about buying your lease car before the lease is up. Be careful when this happens because this can mean that they are facing a loss if they have to wholesale your car at the auction. They are calling you to sell you your car for more money than they can get for it at the auction.

That is why you need to establish the current wholesale market value for your car. Car dealers call this ACV, for actual cash value. Check the Internet for information on the value of your car. www.kbb.com, the Web site for Kelly Blue Book is one of the best sources. Consumer Reports can also give you this information. The best check on the wholesale value is to actually drive your car to 3 or 4 car dealerships that are franchised for your make. If you drive a Ford, visit as many Ford dealerships as you can and tell them you want to sell your car. You aren’t misleading them because it’s a lease car. You could exercise your option to buy it from the leasing company and then resell it to the dealer, if the dealer’s offer was higher. If you live near a CarMax store, the largest retailer of used cars anywhere, they buy a lot of used cars over the curb and their prices are often competitive, but always check CarMax’s price too.

Now that you are armed with the true market value for your car, you can negotiate the best price with the leasing company. Even if they won’t sell you the car for the ACV, wholesale value, paying as much as $2,000 over wholesale for a car you have absolute confidence in is a good deal. If you can buy it for wholesale or below, you should celebrate!

Another thing to be on the lookout for with the leasing company is when they offer to extend your lease for the same monthly payment you are currently making. That is not a good deal. They are doing this because they will lose money if they sell this car at the auction at the present time. They want you to keep making payments on the car so that their depreciation rate catches up with the residual value. The residual value is the price they guessed your car would be worth in 3 years. If you had leased the car for longer at the onset of your lease, the payments would be lower than they are now. Why should you pay the leasing company the same as they charged you for a shorter lease?

Important Links

Just Added: New link to Florida AG!

Monday, January 25, 2016

Monday, January 18, 2016

Leasing is the Dealer’s Choice For Bait and Switch Advertising

Car dealers have always known that consumers’ #1 “Hot Button” is the monthly car payment. Most car buyers finance or lease their vehicles and almost everyone budgets their finances on a monthly basis. Your rent or home mortgage payment, food, insurance payments, and your income are usually paid or budgeted monthly. To most of us, the actual cash price of a car is less important to us than how much we can afford to pay per month.

Car dealers and auto manufacturers prefer leasing you a car to selling you one because it’s more profitable to both of them. It’s more profitable to the manufacturer because they have the control over someone to whom they lease that they don’t with a purchaser. Usually the manufacturer’s financing division owns the car you drive, not you and and you must return their car at the end of the lease. Forcing you to go back to the dealer gives them a much better chance of leasing or selling you another car. Dealers love this but, even more, they love the fact that they make about 50% more profit on a lease than a purchase. They can do this because a lease transaction is far more complex than a purchase. With leasing, the focus is on the monthly payment, not the things that actually determine the profit to the dealer like capitalized cost, residual, term or money factor. Most people who lease cars don’t even understand the meanings of this terminology, much less how their low monthly payment is calculated.

If you read my last blog, “Earl Stewart’s Business Ethical Dilemma”, you know about the trend for manufacturers to mandate a minimum price that their dealers are allowed to advertise. Honda was the first to do this, Mazda followed, and Toyota joined them this month. Honda, Mazda, and Toyota dealers who are inclined toward “lowball bait and switch” advertising may now find it more difficult to do on the majority of the car that they sell. If you don’t already know, bait and switch advertising means advertising a product at a price so low (the “bait”) that potential buyers are compelled to respond. These prices are so low, often below actual cost that the dealer does not want to (or will not) sell you the car at the advertised price. He “switches” you to another car that he can make a profit on or he adds hundreds or thousands of dollars unwanted equipment and fees to the advertised price.

This is the very reason that these manufacturers established a minimum price that car dealers are not permitted to advertise below. Clearly, with the best intentions, the manufacturers are trying to put a stop to bait and switch advertising. But as an unintended consequence, this will compel even more dealers to advertise lease payments. A car dealer can advertise as low a lease payment as he wants and still make a big profit as long as he adjusts the “capitalized cost reduction”, “lease factor” and/or term to his liking. The capitalized cost reduction is “lease-speak” for down payment, the money factor is “lease-speak” for interest rate and the term is the number of months of the lease.

Not only don’t most people who lease understand “cap cost reduction” and “money factor” but this information is concealed in the fine print. The prospective lease customer that comes into the dealership to lease that new Honda for $199 per month could not read the fine print requiring a $5,000 capitalized cost reduction (read “down payment”). Without that large down payment the real payment is $399 per month. The payment can also be manipulated by adjusting the term of the lease and the allowable miles or by not being clear about the total cash out-of-pocket required at signing.

You would think that there are regulations preventing advertisers from hiding material information affecting the true lease payment of a car in the fine print and you’d be right. The Federal Trade Commission has such regulations but they are rarely enforced. State and local regulators almost never enforce such FTC rules. The essence of the FTC law is that anything in an advertisement that materially affects the price or payment must be “clearly and conspicuously” shown.

You can test the FTC’s Clear and Conspicuous Standard with these questions:

• Prominence: Is the fine print big enough for people to notice and read?

• Presentation: Is the wording and format easy for people to understand?

• Placement: Is the fine print where people will look?

• Proximity: Is the fine print near the claim it qualifies?

The next time you see a car dealers TV advertisement, try to read the fine print. It’s flashed on the screen for such a short period of time you might not even realize that there was fine print. Fine print in almost all TV ads is practically impossible to read. The same is true with radio “audible fine print” and most newspaper or Internet fine print.

My advice to you is to be leery of all car dealer ads but be especially leery of leasing ads. If you cannot find the capitalized cost reduction, lease factor, and the term in the advertisement, then the advertised payment is absolutely meaningless and certainly much higher than advertised. If you see an advertisement that violates FTC regulations, click on this website, www.FloridaCarDealerComplaints.com. You can download a complaint form from the Florida State Attorney General’s Office, Florida Department of Motor Vehicles, and the Florida Office of Consumer Affairs.

Car dealers and auto manufacturers prefer leasing you a car to selling you one because it’s more profitable to both of them. It’s more profitable to the manufacturer because they have the control over someone to whom they lease that they don’t with a purchaser. Usually the manufacturer’s financing division owns the car you drive, not you and and you must return their car at the end of the lease. Forcing you to go back to the dealer gives them a much better chance of leasing or selling you another car. Dealers love this but, even more, they love the fact that they make about 50% more profit on a lease than a purchase. They can do this because a lease transaction is far more complex than a purchase. With leasing, the focus is on the monthly payment, not the things that actually determine the profit to the dealer like capitalized cost, residual, term or money factor. Most people who lease cars don’t even understand the meanings of this terminology, much less how their low monthly payment is calculated.

If you read my last blog, “Earl Stewart’s Business Ethical Dilemma”, you know about the trend for manufacturers to mandate a minimum price that their dealers are allowed to advertise. Honda was the first to do this, Mazda followed, and Toyota joined them this month. Honda, Mazda, and Toyota dealers who are inclined toward “lowball bait and switch” advertising may now find it more difficult to do on the majority of the car that they sell. If you don’t already know, bait and switch advertising means advertising a product at a price so low (the “bait”) that potential buyers are compelled to respond. These prices are so low, often below actual cost that the dealer does not want to (or will not) sell you the car at the advertised price. He “switches” you to another car that he can make a profit on or he adds hundreds or thousands of dollars unwanted equipment and fees to the advertised price.

This is the very reason that these manufacturers established a minimum price that car dealers are not permitted to advertise below. Clearly, with the best intentions, the manufacturers are trying to put a stop to bait and switch advertising. But as an unintended consequence, this will compel even more dealers to advertise lease payments. A car dealer can advertise as low a lease payment as he wants and still make a big profit as long as he adjusts the “capitalized cost reduction”, “lease factor” and/or term to his liking. The capitalized cost reduction is “lease-speak” for down payment, the money factor is “lease-speak” for interest rate and the term is the number of months of the lease.

Not only don’t most people who lease understand “cap cost reduction” and “money factor” but this information is concealed in the fine print. The prospective lease customer that comes into the dealership to lease that new Honda for $199 per month could not read the fine print requiring a $5,000 capitalized cost reduction (read “down payment”). Without that large down payment the real payment is $399 per month. The payment can also be manipulated by adjusting the term of the lease and the allowable miles or by not being clear about the total cash out-of-pocket required at signing.

You would think that there are regulations preventing advertisers from hiding material information affecting the true lease payment of a car in the fine print and you’d be right. The Federal Trade Commission has such regulations but they are rarely enforced. State and local regulators almost never enforce such FTC rules. The essence of the FTC law is that anything in an advertisement that materially affects the price or payment must be “clearly and conspicuously” shown.

You can test the FTC’s Clear and Conspicuous Standard with these questions:

• Prominence: Is the fine print big enough for people to notice and read?

• Presentation: Is the wording and format easy for people to understand?

• Placement: Is the fine print where people will look?

• Proximity: Is the fine print near the claim it qualifies?

The next time you see a car dealers TV advertisement, try to read the fine print. It’s flashed on the screen for such a short period of time you might not even realize that there was fine print. Fine print in almost all TV ads is practically impossible to read. The same is true with radio “audible fine print” and most newspaper or Internet fine print.

My advice to you is to be leery of all car dealer ads but be especially leery of leasing ads. If you cannot find the capitalized cost reduction, lease factor, and the term in the advertisement, then the advertised payment is absolutely meaningless and certainly much higher than advertised. If you see an advertisement that violates FTC regulations, click on this website, www.FloridaCarDealerComplaints.com. You can download a complaint form from the Florida State Attorney General’s Office, Florida Department of Motor Vehicles, and the Florida Office of Consumer Affairs.

Tuesday, January 12, 2016

Earl Stewart’s Business Ethical Dilemma

An ethical dilemma is a complex situation that involves a mental conflict between moral imperatives, in which to obey one would result in transgressing another. One was recently forced upon me by Toyota Motor Sales, TMS, for whom I’m franchised to sell new Toyotas.

Most auto manufacturers have rules preventing their dealers from illegal and unethical advertising; however most manufacturers do not enforce these rules very strictly. When dealers violate them they merely get a slap on the wrist. Honda was the exception to the rule. For many years Honda had a unique rule for their dealers. They were strictly prohibited from advertising a price below dealer invoice. Mazda copied this rule a few years ago. This month, January 2016, Toyota added this rule.

The reason these three manufacturers wanted to restrict their dealers from advertising prices below dealer invoice was to prevent “bait and switch” advertisements. The manufacturers know what their dealers sell their cars for (transaction price) and they can monitor the advertised prices. They learned that the advertised prices were hundreds, even thousands of dollars lower than the prices they were actually selling their cars for. By putting a floor on the price that dealers could advertise, they hoped to bring the transaction prices close to the advertised prices.

You might be wondering why establishing the “invoice” as the minimum, or floor price would make any difference. Many car buyers believe that the dealer invoice is the true cost of the car; it is not. In reality, the invoice a car dealer receives from the manufacturer can include thousands of dollars in profit to the dealer. This extra profit is made up by several rebates or kickbacks that are remitted to the dealer by the manufacturer after the invoice is paid. Some of these "holdbacks" that are refunded to the dealers amount to 2%, 3%, or even 4% of MSRP. Requiring their dealers to raise their advertised price to the car’s invoice substantially raises the average advertised price.

As you know, dealers advertise a lot, probably more than just about any other retailer. A Ford dealer’s biggest competitors are the other Ford dealers in his market. They are all selling the exact same vehicles and the main thing that they have to differentiate themselves to Ford buyers is the lowest price. When a Ford dealer advertises on the Internet, TV, radio, or newspaper, it has to show you its lowest price otherwise you will buy from the Ford dealer that does. This is why the prices that Ford dealers really sell their cars for is much higher than their advertised prices. You probably have personally experienced this phenomenon. Can you recall ever buying a new car for the advertised price? Or did pay a dealer fee, doc fee, and pay for dealer installed accessories that were added to the advertised price? Maybe the car they advertised was “just sold” and they had only one available at that price. Or maybe, you feel like they gave you far less for your trade-in than you felt it was worth.

Because of this you can understand why the auto manufacturers are becoming concerned: the dealers who represent their brands are giving them a bad name! Gallup has published an annual poll entitled “Honest and Ethics in Professions” for over 30 years and car salesmen have ranked at or near the bottom of that poll each and every year. The auto franchise system is “broken” but state franchise laws force the auto manufacturers to use car dealers to sell their vehicles. These laws were lobbied into effect by car dealers and their associations over the last 50 years. Furthermore, even if the state laws could be overturned, GM, Ford, Chrysler, Toyota, Honda and the others are not prepared, equipped, or inclined to sell their cars direct. Tesla is already selling cars directly without a dealer network. Apple and Google are talking about selling cars directly too. These forward-thinking companies are keenly attuned to what consumers want. Additionally, companies like TrueCar are helping to sell cars online by offering honest, low prices with total transparency. With public sentiment so negative against car dealers, the manufacturers are afraid that they may be put in the position of having to sell cars direct whether they like it or not. They believe that the better course of action is to change the unfair and deceptive advertising and sales practices of their dealers.

This brings me to my “ethical dilemma”. I’m one of the very few “one-price” car dealers. This means that I post my lowest price on every new and used car I sell. My car dealership is just like the Apple Store, Amazon, or Publix. We post our lowest prices on all of our products. We post these prices online on our website - our virtual showroom - just like we post prices on the cars in our “brick and mortar” showroom. Unlike most other dealers I don’t advertise prices lower than I will sell the car for. I don’t make my customers negotiate with me before they can get my lowest price any more than Apple would make you haggle with them before you could get their lowest price on a MacBook computer or an iPhone.

Toyota, like Honda and Mazda, is now telling their dealers that they cannot post a price on the cars displayed in their virtual, online showrooms if it is below the car’s invoice. They define it as advertising and I disagree with that. Because approximately one-third of cars that I sell are sold below invoice, this gives me only two choices. I can raise those prices several hundreds of dollars or I can show no price at all. If I raise my prices, I would be charging my customers more than I think is fair. If I don't display a price, I am not fulfilling the promise I made to my customers when I became a one-price dealer - to provide simple, honest up-front pricing.

Toyota, Mazda, and Honda’s rule on “no advertising of prices below dealer invoice” is well intended, but I don’t think they understood the unintended consequences of their actions. This rule is a serious blow to the small but growing number of legitimate one-price dealers like me. Retailers posting prices on their product is standard for nearly every product except for automobiles. The car dealer practice of haggling with customers is a relic and it's reminiscent of horse-trading in the 19th century. This well intended rule will discourage car dealers from moving into the 21st century where retailers tell their customers their lowest prices upfront without the haggle and hassle.

So there you have it. If I refuse to follow Toyota’s rules, I will be subjected to huge financial penalties which could put me out of business. If I obey Toyota’s rules I’m not being honest and transparent in my commitment to my customers about putting my lowest price on every car I sell.

I’m looking for advice and guidance from my customers on my dilemma. You can text or call me on my cell phone at 561 358-1474. You can email me at earl@earloncars.com.

Most auto manufacturers have rules preventing their dealers from illegal and unethical advertising; however most manufacturers do not enforce these rules very strictly. When dealers violate them they merely get a slap on the wrist. Honda was the exception to the rule. For many years Honda had a unique rule for their dealers. They were strictly prohibited from advertising a price below dealer invoice. Mazda copied this rule a few years ago. This month, January 2016, Toyota added this rule.

The reason these three manufacturers wanted to restrict their dealers from advertising prices below dealer invoice was to prevent “bait and switch” advertisements. The manufacturers know what their dealers sell their cars for (transaction price) and they can monitor the advertised prices. They learned that the advertised prices were hundreds, even thousands of dollars lower than the prices they were actually selling their cars for. By putting a floor on the price that dealers could advertise, they hoped to bring the transaction prices close to the advertised prices.

You might be wondering why establishing the “invoice” as the minimum, or floor price would make any difference. Many car buyers believe that the dealer invoice is the true cost of the car; it is not. In reality, the invoice a car dealer receives from the manufacturer can include thousands of dollars in profit to the dealer. This extra profit is made up by several rebates or kickbacks that are remitted to the dealer by the manufacturer after the invoice is paid. Some of these "holdbacks" that are refunded to the dealers amount to 2%, 3%, or even 4% of MSRP. Requiring their dealers to raise their advertised price to the car’s invoice substantially raises the average advertised price.

As you know, dealers advertise a lot, probably more than just about any other retailer. A Ford dealer’s biggest competitors are the other Ford dealers in his market. They are all selling the exact same vehicles and the main thing that they have to differentiate themselves to Ford buyers is the lowest price. When a Ford dealer advertises on the Internet, TV, radio, or newspaper, it has to show you its lowest price otherwise you will buy from the Ford dealer that does. This is why the prices that Ford dealers really sell their cars for is much higher than their advertised prices. You probably have personally experienced this phenomenon. Can you recall ever buying a new car for the advertised price? Or did pay a dealer fee, doc fee, and pay for dealer installed accessories that were added to the advertised price? Maybe the car they advertised was “just sold” and they had only one available at that price. Or maybe, you feel like they gave you far less for your trade-in than you felt it was worth.

Because of this you can understand why the auto manufacturers are becoming concerned: the dealers who represent their brands are giving them a bad name! Gallup has published an annual poll entitled “Honest and Ethics in Professions” for over 30 years and car salesmen have ranked at or near the bottom of that poll each and every year. The auto franchise system is “broken” but state franchise laws force the auto manufacturers to use car dealers to sell their vehicles. These laws were lobbied into effect by car dealers and their associations over the last 50 years. Furthermore, even if the state laws could be overturned, GM, Ford, Chrysler, Toyota, Honda and the others are not prepared, equipped, or inclined to sell their cars direct. Tesla is already selling cars directly without a dealer network. Apple and Google are talking about selling cars directly too. These forward-thinking companies are keenly attuned to what consumers want. Additionally, companies like TrueCar are helping to sell cars online by offering honest, low prices with total transparency. With public sentiment so negative against car dealers, the manufacturers are afraid that they may be put in the position of having to sell cars direct whether they like it or not. They believe that the better course of action is to change the unfair and deceptive advertising and sales practices of their dealers.

This brings me to my “ethical dilemma”. I’m one of the very few “one-price” car dealers. This means that I post my lowest price on every new and used car I sell. My car dealership is just like the Apple Store, Amazon, or Publix. We post our lowest prices on all of our products. We post these prices online on our website - our virtual showroom - just like we post prices on the cars in our “brick and mortar” showroom. Unlike most other dealers I don’t advertise prices lower than I will sell the car for. I don’t make my customers negotiate with me before they can get my lowest price any more than Apple would make you haggle with them before you could get their lowest price on a MacBook computer or an iPhone.

Toyota, like Honda and Mazda, is now telling their dealers that they cannot post a price on the cars displayed in their virtual, online showrooms if it is below the car’s invoice. They define it as advertising and I disagree with that. Because approximately one-third of cars that I sell are sold below invoice, this gives me only two choices. I can raise those prices several hundreds of dollars or I can show no price at all. If I raise my prices, I would be charging my customers more than I think is fair. If I don't display a price, I am not fulfilling the promise I made to my customers when I became a one-price dealer - to provide simple, honest up-front pricing.

Toyota, Mazda, and Honda’s rule on “no advertising of prices below dealer invoice” is well intended, but I don’t think they understood the unintended consequences of their actions. This rule is a serious blow to the small but growing number of legitimate one-price dealers like me. Retailers posting prices on their product is standard for nearly every product except for automobiles. The car dealer practice of haggling with customers is a relic and it's reminiscent of horse-trading in the 19th century. This well intended rule will discourage car dealers from moving into the 21st century where retailers tell their customers their lowest prices upfront without the haggle and hassle.

So there you have it. If I refuse to follow Toyota’s rules, I will be subjected to huge financial penalties which could put me out of business. If I obey Toyota’s rules I’m not being honest and transparent in my commitment to my customers about putting my lowest price on every car I sell.

I’m looking for advice and guidance from my customers on my dilemma. You can text or call me on my cell phone at 561 358-1474. You can email me at earl@earloncars.com.

Subscribe to:

Comments (Atom)