I consider myself pretty good with words, but I cannot fully express how happy Nancy and I are to be back on the air assisting you and all South Floridians with their car buying and servicing issues. We answered all of your questions for seven years from our live, one-hour talk show on Seaview Radio, but had to take a thirteen month hiatus from November 2013.

You can tune us in any Tuesday afternoon from 4pm to 6pm on JVC Broadcasting’s, “900 The Talk of the Palm Beaches”. That’s 900 on your AM dial. Our first show is Tuesday, December 16 and if you read this blog in time, we encourage you to listen and call the show with your comments and questions. You can stream the show live by following this link Stream Earl & Nancy LIVE.Our show is live, but it will be recorded for replay on Sundays from also from 4 PM to 6 PM. I’m excited to say that our show will also be simulcast live in Long Island, NY on 103.9, LI News Radio. Nancy and I will be off the air for the holidays, Christmas Eve and New Year’s Eve, but back on again Tuesday, January 7.

Nancy and I would like to thank the new owners of Seaview Radio, John Caracciolo, and Vic Canales for allowing former Seaview and current JVC General Manager, Chet Tart, to reinstate our show and expand the hours and frequency. But wait there’s more! “900: The Talk of the Palm Beaches” has ten times the power of our old Seaview station. The new signal for Earl Stewart on Cars reaches north to Vero Beach, south to Pompano, and west to Ft. Myers. We will reach, literally hundreds of thousands more listeners!

Furthermore, we are adding an entire new dimension to our show with Rick Kearney, a Certified Diagnostic Master Auto Technician. Rick knows “everything” about the mechanics of automobiles. He can answer all of your questions about problems you have with your car or truck, how to be avoid being ripped off by a mechanic or service department, and how best to economically service your vehicle.

For those of you who have not listened to our radio show in the past, we offer something similar to this blog and newspaper column, but more and “live” so that you can call us and answer all of your questions. You may be in the process of buying a used or new car and need advice on how to find the lowest price, what makes and models are best for you, or which car dealers can you trust the most. You may have already bought a car and would like to share your purchasing experience, good or bad, with Nancy, me, and our radio audience. You might wonder if those “extra services” that the person you take your car to are really needed or if the price they are charging you is fair.

Someone once said that buying and servicing a car is like having a root canal without the anesthetic. We would like to offer you some advice that will not only act as an anesthetic, but actually turn the buying an servicing of cars into a pleasurable experience. If you listen to Earl Stewart on Cars, you will hear me quote Jim Press, the former CEO for Toyota for all of North America and the first non-Japanese to sit on Toyota’s board of directors, “The way you treat the customer when you do not owe them anything, like how you treat somebody who cannot fight back—that is the ultimate test of character.” This sums up Nancy’s and my ultimate goal which is to ensure that all car dealers and service departments in South Florida understand the truth of this statement.

Important Links

Just Added: New link to Florida AG!

Monday, December 15, 2014

Monday, December 08, 2014

Dealing With the Dealer Fee - Earl Stewart's User Guide

Hopefully by now, all but my newest readers know about the infamous “Dealer Fee”. If you don’t know, it’s a hidden price increase on the car you purchase disguised to look like a federal, state, or local tax or fee. It’s actually 100% profit to the dealer. “Dealer Fee” is the most common name for this disguised profit, but it goes by many names such as doc fee, dealer prep fee, service fee, administrative fee, electronic filing fee, e-filing fee, tag agency fee, pre-delivery fee, etc. The names are only limited by car dealers’ imaginations. Almost all car dealers in Florida charge a Dealer Fee. The dealer fees range from around $700 to as high as $2,000!

This is the Florida law that is supposed to regulate the Dealer Fee: “The advertised price must include all fees or charges that the customer must pay excluding state and local taxes.” The law also requires that the Dealer Fee must be disclosed to the buyer as follows: “This charge represents costs and profits to the dealer for items such as inspecting, cleaning, and adjusting vehicles and preparing documents related to the sale.”

This law is very weak and almost never enforced. When enforced, it isn’t enforced by the letter of the law; it is done so as to “accommodate” the car dealers. The law is “weak” because it requires only that the dealer fee be included in the “advertised” price. The word “advertised” is narrowly interpreted to mean a specific car shown in a newspaper, TV, radio, or online ad, but, what about when you get a price on the phone, online, or from the salesman? You don’t find out about the Dealer Fee until you’re in the business office signing a bunch of papers. The dealers get around advertisements very easily by including a “number” in the fine print. This number is their stock number that designates one specific car. When you respond to the ad, this car is no longer available (sales people are usually not paid a commission for selling the “ad car). The advertisement might say “many more identical cars are available.” It’s true that identical cars are available for sale, but they are not available for sale at the sale price because they are not the advertised stock number car. If you buy one of those “exact same cars” you will pay from $700 to $2,000 more.

The reason I’m told that the law is rarely enforced is that the Florida Attorney General’s office is understaffed and too busy enforcing other Florida laws. I’m also told that Florida car buyers don’t file very many complaints against car dealers for violating the Dealer Fee law. I don’t believe that there can be too many other infractions of the law that take more money annually from consumers than dealer fees take from car buyers. Just one car dealer selling 1,000 cars a year and charging a $1,000 dealer fee is taking a $1 million annually from car buyers. Most car dealers in South Florida well a lot more than 1,000 cars annually and many charge more than $1,000 dealer fee. I believe that the reason more complaints aren’t filed on the dealer fee is because most car buyers don’t know that they are being duped. They either don’t notice the fee or assume it’s an official federal or state fee. Dealer often tell their customers that all dealers charge it and that it’s required by law.

The Attorney General also “accommodates” the dealers by not interpreting the law the way it was intended. For example, the law says that the dealer fee must be included in the advertised price. The Florida Senate has ruled that the law requires that the fee be “included” rather than “specifically delineated.” But the Attorney General allows car dealers to advertise car prices without including their dealer fee in the price if they mention their dealer fee in the fine print. They also allow car dealers to simply state in the fine print that they have a Dealer Fee but not even mention the amount. To me they are simply allowing the car dealers to break the law.

Lastly, the required disclosure of the Dealer Fee on the vehicle buyer’s order or invoice is confusing, misleading, and incorrect: “This charge represents costs and profits to the dealer for items such as inspecting, cleaning, and adjusting vehicles and preparing documents related to the sale.” It should not say “costs” because any cost that you pass along to the customer in the price of a product is pure profit. A dealer can pass along his utility bills, sales commissions and advertising if he wants to and call it a “dealer fee”. It should not say “inspecting, cleaning, and adjusting vehicles” because all car dealers are reimbursed by the manufacturer for “inspecting, cleaning, and adjusting vehicles”.

So, what should you do when you are confronted by a car dealer with the “Dealer Fee”? Besides “LEAVE”, here are some suggestions that may help you:

(1) Make it clear from the very beginning that all prices you discuss must be “out-the-door” prices. This way you don’t care if the dealer fee added up front because you will shop and compare their bottom line price with at least 3 competing car dealers. Ideally you should require that they include tax and tag in that price. If you don’t they might try to slip in something they call the “electronic filing fee” or “e filing fee” and trick you into believing it’s part of the license tag and registration.

(2) The dealer will often tell you that all car dealers charge Dealer Fees and that they are required by law to add the dealer fee on every car they sell. Simply tell them that you know this is not true and you can cite me and other car dealers like Mullinax Ford who do not charge a dealer fee. Print out a copy of this article, show it to them, and tell them that you know that there is no law that says he must charge you a dealer fee.

(3) As long as you and the dealer understand that the out-the-door price is the price you will shop and compare with his competition, you don’t need to be concerned whether there is a dealer fee showing on the vehicle buyer’s order. To be competitive, the dealer can simply reduce the price by the amount of his Dealer Fee and the bottom line is what you are comparing.

(4) Be aware that dealers usually do not pay their sales people a commission on the amount of their dealer fee. In fact, dealers often misinform their sales people just like they do their customers. The salesman who tells you that the all dealers charge Dealer Fees and that the law requires everyone pay a dealer fee may actually believe it. Sale people who understand that the Dealer Fee is simply profit to the dealer will be resentful of not being paid their 25% commission on it. A $1,000 dealer fee costs the salesman $250 in commission.

(5) When you respond to an advertisement at a specific price for a specific model car, object when the dealer adds the dealer fee. Unfortunately, the law allows him the loophole of claiming that the ad car is a different stock number, but you might be able to shame him into taking off the dealer fee. If you raise a “big enough stink”, the dealer would be smart to take off the dealer fee than claim that technicality, especially if you were to advise the local TV station or newspaper.

I hope that these suggestions help you and I hope that you will file a complaint with the Florida Attorney General, Pam Bondi. If enough consumers (who are also voters) let our elected officials know how they feel about the Dealer Fee, it will bring positive results.

This is the Florida law that is supposed to regulate the Dealer Fee: “The advertised price must include all fees or charges that the customer must pay excluding state and local taxes.” The law also requires that the Dealer Fee must be disclosed to the buyer as follows: “This charge represents costs and profits to the dealer for items such as inspecting, cleaning, and adjusting vehicles and preparing documents related to the sale.”

This law is very weak and almost never enforced. When enforced, it isn’t enforced by the letter of the law; it is done so as to “accommodate” the car dealers. The law is “weak” because it requires only that the dealer fee be included in the “advertised” price. The word “advertised” is narrowly interpreted to mean a specific car shown in a newspaper, TV, radio, or online ad, but, what about when you get a price on the phone, online, or from the salesman? You don’t find out about the Dealer Fee until you’re in the business office signing a bunch of papers. The dealers get around advertisements very easily by including a “number” in the fine print. This number is their stock number that designates one specific car. When you respond to the ad, this car is no longer available (sales people are usually not paid a commission for selling the “ad car). The advertisement might say “many more identical cars are available.” It’s true that identical cars are available for sale, but they are not available for sale at the sale price because they are not the advertised stock number car. If you buy one of those “exact same cars” you will pay from $700 to $2,000 more.

The reason I’m told that the law is rarely enforced is that the Florida Attorney General’s office is understaffed and too busy enforcing other Florida laws. I’m also told that Florida car buyers don’t file very many complaints against car dealers for violating the Dealer Fee law. I don’t believe that there can be too many other infractions of the law that take more money annually from consumers than dealer fees take from car buyers. Just one car dealer selling 1,000 cars a year and charging a $1,000 dealer fee is taking a $1 million annually from car buyers. Most car dealers in South Florida well a lot more than 1,000 cars annually and many charge more than $1,000 dealer fee. I believe that the reason more complaints aren’t filed on the dealer fee is because most car buyers don’t know that they are being duped. They either don’t notice the fee or assume it’s an official federal or state fee. Dealer often tell their customers that all dealers charge it and that it’s required by law.

The Attorney General also “accommodates” the dealers by not interpreting the law the way it was intended. For example, the law says that the dealer fee must be included in the advertised price. The Florida Senate has ruled that the law requires that the fee be “included” rather than “specifically delineated.” But the Attorney General allows car dealers to advertise car prices without including their dealer fee in the price if they mention their dealer fee in the fine print. They also allow car dealers to simply state in the fine print that they have a Dealer Fee but not even mention the amount. To me they are simply allowing the car dealers to break the law.

Lastly, the required disclosure of the Dealer Fee on the vehicle buyer’s order or invoice is confusing, misleading, and incorrect: “This charge represents costs and profits to the dealer for items such as inspecting, cleaning, and adjusting vehicles and preparing documents related to the sale.” It should not say “costs” because any cost that you pass along to the customer in the price of a product is pure profit. A dealer can pass along his utility bills, sales commissions and advertising if he wants to and call it a “dealer fee”. It should not say “inspecting, cleaning, and adjusting vehicles” because all car dealers are reimbursed by the manufacturer for “inspecting, cleaning, and adjusting vehicles”.

So, what should you do when you are confronted by a car dealer with the “Dealer Fee”? Besides “LEAVE”, here are some suggestions that may help you:

(1) Make it clear from the very beginning that all prices you discuss must be “out-the-door” prices. This way you don’t care if the dealer fee added up front because you will shop and compare their bottom line price with at least 3 competing car dealers. Ideally you should require that they include tax and tag in that price. If you don’t they might try to slip in something they call the “electronic filing fee” or “e filing fee” and trick you into believing it’s part of the license tag and registration.

(2) The dealer will often tell you that all car dealers charge Dealer Fees and that they are required by law to add the dealer fee on every car they sell. Simply tell them that you know this is not true and you can cite me and other car dealers like Mullinax Ford who do not charge a dealer fee. Print out a copy of this article, show it to them, and tell them that you know that there is no law that says he must charge you a dealer fee.

(3) As long as you and the dealer understand that the out-the-door price is the price you will shop and compare with his competition, you don’t need to be concerned whether there is a dealer fee showing on the vehicle buyer’s order. To be competitive, the dealer can simply reduce the price by the amount of his Dealer Fee and the bottom line is what you are comparing.

(4) Be aware that dealers usually do not pay their sales people a commission on the amount of their dealer fee. In fact, dealers often misinform their sales people just like they do their customers. The salesman who tells you that the all dealers charge Dealer Fees and that the law requires everyone pay a dealer fee may actually believe it. Sale people who understand that the Dealer Fee is simply profit to the dealer will be resentful of not being paid their 25% commission on it. A $1,000 dealer fee costs the salesman $250 in commission.

(5) When you respond to an advertisement at a specific price for a specific model car, object when the dealer adds the dealer fee. Unfortunately, the law allows him the loophole of claiming that the ad car is a different stock number, but you might be able to shame him into taking off the dealer fee. If you raise a “big enough stink”, the dealer would be smart to take off the dealer fee than claim that technicality, especially if you were to advise the local TV station or newspaper.

I hope that these suggestions help you and I hope that you will file a complaint with the Florida Attorney General, Pam Bondi. If enough consumers (who are also voters) let our elected officials know how they feel about the Dealer Fee, it will bring positive results.

Monday, December 01, 2014

Don’t Fall For Nitrogen (What Car Dealers Tell You Is Nonsense)

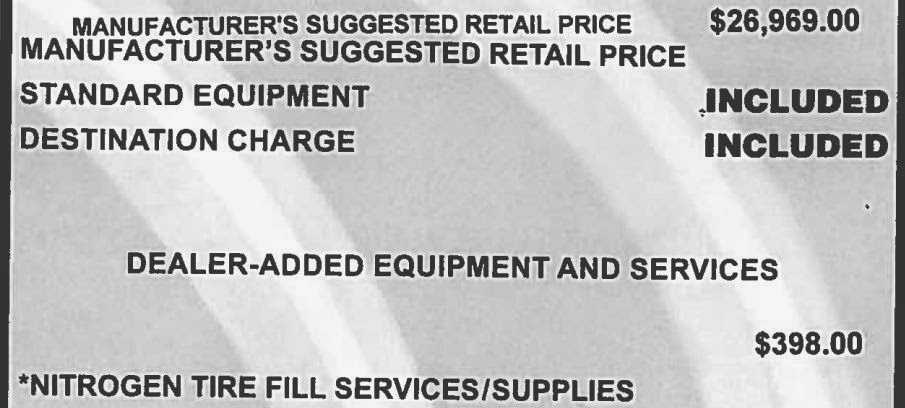

I’ve been

writing articles on why nitrogen in your tires is a waste of money for several

years, but It has had very little effect on the number of car dealers that are

selling it to their customers. The “Nitrogen Lobby” must be very powerful

because we still have no federal or state legislation to curtail this. Selling

nitrogen generation equipment and tanks of nitrogen to car dealers is very

lucrative and, even more lucrative is the money car dealers make selling

nitrogen to their customers. One large volume car dealer charges $398 for

nitrogen in the tires of every vehicle he sells. The cost of nitrogen is

about “25 cents” per application. If you feel you absolutely must have nitrogen

in your tires, Costco will give it to you “free” which is exactly what nitrogen

in your tires is worth.

I don’t

recommend that you even accept free nitrogen for this reason. It’s

widely accepted and recommended that you should have your tire pressure checked

in your tires at least monthly. We do this free for our customers and

automatically do it at every service visit. When you are sold or even given

nitrogen, it comes with a sales pitch that nitrogen will remain in your tires

for a much longer time than air which is not true. Click on this link to

Consumer Reports article, www.NitrogenInTiresWastesYourMoney.com. If you believe the sales pitch, you’re less

likely to check your tires inflation every 30 days. You may have a slow leak in

one tire from a nail or screw, uneven wear from misalignment, or even a

defective tire. Being “over confident” because you paid money for nitrogen may

cause these problems to go undetected. Consumer Reports estimates that 1lb of nitrogen will escape from your tires

every 3 months vs. 1 month for air. Remember that air is 78% nitrogen. I’ll bet

the salesman that sells you nitrogen “forgot” to tell you that.

Be prepared

for a great sales pitch on nitrogen. You’ll be told that NASCAR uses

nitrogen in the tires of their race cars, NASA used nitrogen in the tires of

their space shuttle, and that airlines uses nitrogen in airplane tires. All of

this is true, but so what? A race car going 200 mph for hours and hours around

an oval track subjects its tires to extremely high temperatures. 100% nitrogen

gas does expand less under extreme heat condition than 78% nitrogen gas (air).

The space shuttle tires go from zero atmospheric pressure in outer space to

regular pressure at sea level. Airliners also have extreme pressure variations

from 30,000 feet to the ground.

To be

perfectly fair, I must say that some car dealers that are selling nitrogen have

“drunk the Kool Ade” from the nitrogen generation equipment industry. Some car

dealers actually believe that nitrogen is good for your tires. But those

who do know must know how much they’re marking up that 25 cents worth of

nitrogen they’re selling you! The argument for nitrogen can be persuasive. In

fact, when the concept was first introduced, before the Consumer Reports study, I actually considered adding nitrogen to my

customers’ tires. But, in an abundance of caution, I decided to test the claims

about nitrogen myself. Over a six month period I used pure nitrogen in 50% of

my rental car fleet and regular air (78% nitrogen) in the other half. Guess

what! There was no measurable difference between the pure nitrogen and air

filled tires in the fuel economy, tire wear, or inflation pressure after 6

months. We did check the tires every 30 days for slow leaks from road hazards,

uneven wear from misalignment or other reasons, and we rotated and balanced the

tires every 5,000 miles.

Finally,

I’ll tell you why I was so careful to be sure there was no advantage to

nitrogen. My dealership has a “fee tire program”. Everybody who buys a Toyota

from me, new or used, receives free tires (maximum of $700 per set) for as long

as they own their car. The one requirement is that they bring their car back to

me for the factory recommended service and we replace only tires from normal

wear, not road hazards, underinflating or misalignment. I give away over

$100,000 worth of tires every month, well over a million dollars per year.

BELIEVE ME, if I thought I could get longer wear from a tire for “25 cents”

worth of nitrogen, I would! I look at the tires on my customers’ cars as

“belonging to me” because I incur the cost of replacing them when they wear

out.

Monday, November 24, 2014

Should I Trade In My Old Car or Sell It Myself?

When you trade your old car in on your next car, the dealer will try to retail your car or sell it at auction for more than he allowed you in trade. If he successfully retails your car, he will make about $2,000. If he wholesales it at the auction, the profit will be less. You should know that this is what the dealer wants to do. Sometimes it doesn’t work out that way and he will actually lose money on your car at the auction. Or, he may be unable to retail your car and then most certainly lose money when he is forced to wholesale it.

Obviously it is more difficulty for an individual to make a profit by selling her own trade-in than it is for the dealer. That is one of the main consideration you must consider before deciding to sell your old car yourself. Most people run an ad in the local paper and/or online to advertise their trade. If you do this, you need to know what to ask for your car and I recommend consulting www.kbb.com. This is Kelly Blue Book’s Web site and will tell you about what your car is worth wholesale and retail. Another way to determine this is to ask dealers for your make of your car what they will buy it for. This will establish the wholesale value. CarMax is a good company to consult if there is one near you. Once you establish the wholesale, you should consider a markup of less than what car dealers are asking. When deciding how much profit you want to make, remember that you are losing the sales tax reduction that you earn when you trade your car in. On a $20,000 trade, that amounts to $1,200. If you can make a $2,100 above wholesale, you are ahead of the game by $1,000. This takes a lot of work and you will be dealing with a lot of “tire-kickers” and people who cannot afford to buy your car. I very strongly advise you not to extend credit. Require full payment in cash. Set a time limit on how long you will try to sell your car. Remember that your used car is depreciating every week and your cost of advertising will climb. I wouldn’t suggest you hang on to your old car for more than a month.

Ebay is a good alternative to advertising your car in the newspaper. A lot of car dealers use Ebay to retail used cars and it is very effective. There are schools on how to retail merchandise on Ebay and Ebay has tutorials. There are also a lot of books at any bookstore on this subject. There are companies who will do all of the work for you and you only pay them a fee if they are successful in selling your car. If the dealer you are buying your new car from sells cars on Ebay (most do), you can ask him if he will post yours Ebay along with his cars for a fee.

If you fail in your attempt to retail your old car, remember to be careful to maximize the amount you get from your dealer as trade-in. Often times dealers will attempt to trade a car in for below wholesale. Be sure you have a firm handle on the true wholesale value of your trade. You can get bids from other dealerships to purchase your car for cash and you can check with www.kbb.com. If you are buying a car from a dealer franchised to sell a different make than your trade-in, be wary. This dealer will likely be unable to offer you as much as a dealer who is franchised to sell the make of your trade. People looking to buy a used Toyota are more likely to visit a Toyota dealership than a Chevrolet dealership. That is why it’s important to get bids from other dealerships before accepting the trade-in offered by the dealer you’re buying your new car from.

Obviously it is more difficulty for an individual to make a profit by selling her own trade-in than it is for the dealer. That is one of the main consideration you must consider before deciding to sell your old car yourself. Most people run an ad in the local paper and/or online to advertise their trade. If you do this, you need to know what to ask for your car and I recommend consulting www.kbb.com. This is Kelly Blue Book’s Web site and will tell you about what your car is worth wholesale and retail. Another way to determine this is to ask dealers for your make of your car what they will buy it for. This will establish the wholesale value. CarMax is a good company to consult if there is one near you. Once you establish the wholesale, you should consider a markup of less than what car dealers are asking. When deciding how much profit you want to make, remember that you are losing the sales tax reduction that you earn when you trade your car in. On a $20,000 trade, that amounts to $1,200. If you can make a $2,100 above wholesale, you are ahead of the game by $1,000. This takes a lot of work and you will be dealing with a lot of “tire-kickers” and people who cannot afford to buy your car. I very strongly advise you not to extend credit. Require full payment in cash. Set a time limit on how long you will try to sell your car. Remember that your used car is depreciating every week and your cost of advertising will climb. I wouldn’t suggest you hang on to your old car for more than a month.

Ebay is a good alternative to advertising your car in the newspaper. A lot of car dealers use Ebay to retail used cars and it is very effective. There are schools on how to retail merchandise on Ebay and Ebay has tutorials. There are also a lot of books at any bookstore on this subject. There are companies who will do all of the work for you and you only pay them a fee if they are successful in selling your car. If the dealer you are buying your new car from sells cars on Ebay (most do), you can ask him if he will post yours Ebay along with his cars for a fee.

If you fail in your attempt to retail your old car, remember to be careful to maximize the amount you get from your dealer as trade-in. Often times dealers will attempt to trade a car in for below wholesale. Be sure you have a firm handle on the true wholesale value of your trade. You can get bids from other dealerships to purchase your car for cash and you can check with www.kbb.com. If you are buying a car from a dealer franchised to sell a different make than your trade-in, be wary. This dealer will likely be unable to offer you as much as a dealer who is franchised to sell the make of your trade. People looking to buy a used Toyota are more likely to visit a Toyota dealership than a Chevrolet dealership. That is why it’s important to get bids from other dealerships before accepting the trade-in offered by the dealer you’re buying your new car from.

Monday, November 17, 2014

Don’t Be “Spotted”

When you bought your last new or used vehicle, did the salesman encourage (or even insist) that you drive your vehicle home that same day? The chances are very good that he did because Florida dealers and those in most other states have a firm policy of doing this. I’ll estimate that 90% to 95% of all cars sold in Florida are “spotted” which is the slang expression dealers have for this policy. A few states, like New York, make it illegal to deliver a newly purchased car until the tag, title, and registration process have been finalized which delays the delivery for a few days. As much as you may be tempted, these are 5 reasons you should not sign the papers and drive the newly purchased vehicle home the same day you decide to buy it. Some car buyers are under the impression that there’s a 72 hour “cooling off period” mandated by law that allows you to return purchases, but this is not true when you buy a car at the dealership. It applies only if you purchase the product in your home.

(1) If you’re financing the car through the dealer, there’s a chance that your financing has not been approved based on the same terms, interest rate, and down payment you agreed to. If you bought the car on a weekend or after 5pm, most banks and credit unions are closed. Even if you bought it earlier during a weekday, it can take a day or more for a bank to do a thorough credit investigation and approval. If your credit is later turned down or the down payment, interest rate, or terms modified, you will be faced with the embarrassing necessity of returning the car and resigning a contract that will result in you paying more money than you had agreed to.

(2) Most cars, surprisingly, are purchased on impulse with emotion overcoming logic. The 2nd largest expenditure the average person makes in their life is for their car. This decision should be made with logic, not emotion. Logic dictates that one should spend several weeks studying the pros and cons of the many different vehicles available. The Internet offers a wealth of information. Should you lease or buy? Should you buy a late model used car or a new one? Which dealer offers the lowest price? Which dealer offers the highest price for your trade-in? Which bank or credit union offers the lowest interest rates and terms and down payment acceptable to you? You should never buy a vehicle without an extensive test drive.

(3) The dealer may be insisting that you take delivery immediately because he knows that this is the best way to force your emotion to overcome your logic. When you take your new vehicle home and show it off to your friends, family, and neighbors, you’re far more likely not to change your mind. Because you’ve left your trade-in with the dealer, you’re not going to be checking prices with other dealers. Taking you out of the market by keeping your trade in has a slang term among dealers…you’ve been “de-horsed”. Taking that new car home the same day also has a slang term…you’ve been “puppy-dogged”. Have you ever gone puppy shopping with your family and brought home a warm, cute, and cuddly puppy? What are the chances you’ll return her the next day because the price was too high?

(4) A legally binding contract must have “offer and acceptance.” Taking your car home completely binds the acceptance of the contract, if you signed one, and makes it far less likely that you will be able to get out of the deal you made.

(5) Unscrupulous car dealers will spot deliver cars knowing that the lender will not approve the low interest rate, low down payment, and longer terms that you have agreed to. They’re relying on the fact that you’ll fall in love with your “new puppy” and that you’ll brag to your family, friends, and neighbors how about the low price, low interest rate, etc. that you negotiated. When you get that call from the finance manager at the dealership a few days after delivery that you must come back to “take care of a little more paperwork”, you won’t hesitate. When you get there, you find out that you have to come up with a lot higher down payment, a much higher interest rate, and tell you that you have to buy an extended warranty because “the bank requires it”. Your monthly payment goes way up and so does the dealer’s profit. The dealers have a slang expression for this too…it’s called the “yo-yo delivery”.

If you find yourself in the position of being told to return your purchase because the bank requires a higher interest, higher down payment, or shorter terms be sure that you understand that you have no obligation to sign a new contract and keep the vehicle. Your contract is null and void. There’s even an argument to be made by you and your lawyer that the first contract is valid and that you can keep the car at the original terms agreed upon. You may have signed a paper, typically referred to as a “Recession Agreement”, which purports to require you to return the car if the bank refuses to honor the contract as written. There are financial penalties if you don’t. This was common practice with all Florida car dealers for many years but court decisions, case law, has made this a very questionable practice. I hope that this never happens to you but if it does and you decide you want to keep the car under the terms of the original finance contract, I recommend you hire a lawyer.

(1) If you’re financing the car through the dealer, there’s a chance that your financing has not been approved based on the same terms, interest rate, and down payment you agreed to. If you bought the car on a weekend or after 5pm, most banks and credit unions are closed. Even if you bought it earlier during a weekday, it can take a day or more for a bank to do a thorough credit investigation and approval. If your credit is later turned down or the down payment, interest rate, or terms modified, you will be faced with the embarrassing necessity of returning the car and resigning a contract that will result in you paying more money than you had agreed to.

(2) Most cars, surprisingly, are purchased on impulse with emotion overcoming logic. The 2nd largest expenditure the average person makes in their life is for their car. This decision should be made with logic, not emotion. Logic dictates that one should spend several weeks studying the pros and cons of the many different vehicles available. The Internet offers a wealth of information. Should you lease or buy? Should you buy a late model used car or a new one? Which dealer offers the lowest price? Which dealer offers the highest price for your trade-in? Which bank or credit union offers the lowest interest rates and terms and down payment acceptable to you? You should never buy a vehicle without an extensive test drive.

(3) The dealer may be insisting that you take delivery immediately because he knows that this is the best way to force your emotion to overcome your logic. When you take your new vehicle home and show it off to your friends, family, and neighbors, you’re far more likely not to change your mind. Because you’ve left your trade-in with the dealer, you’re not going to be checking prices with other dealers. Taking you out of the market by keeping your trade in has a slang term among dealers…you’ve been “de-horsed”. Taking that new car home the same day also has a slang term…you’ve been “puppy-dogged”. Have you ever gone puppy shopping with your family and brought home a warm, cute, and cuddly puppy? What are the chances you’ll return her the next day because the price was too high?

(4) A legally binding contract must have “offer and acceptance.” Taking your car home completely binds the acceptance of the contract, if you signed one, and makes it far less likely that you will be able to get out of the deal you made.

(5) Unscrupulous car dealers will spot deliver cars knowing that the lender will not approve the low interest rate, low down payment, and longer terms that you have agreed to. They’re relying on the fact that you’ll fall in love with your “new puppy” and that you’ll brag to your family, friends, and neighbors how about the low price, low interest rate, etc. that you negotiated. When you get that call from the finance manager at the dealership a few days after delivery that you must come back to “take care of a little more paperwork”, you won’t hesitate. When you get there, you find out that you have to come up with a lot higher down payment, a much higher interest rate, and tell you that you have to buy an extended warranty because “the bank requires it”. Your monthly payment goes way up and so does the dealer’s profit. The dealers have a slang expression for this too…it’s called the “yo-yo delivery”.

If you find yourself in the position of being told to return your purchase because the bank requires a higher interest, higher down payment, or shorter terms be sure that you understand that you have no obligation to sign a new contract and keep the vehicle. Your contract is null and void. There’s even an argument to be made by you and your lawyer that the first contract is valid and that you can keep the car at the original terms agreed upon. You may have signed a paper, typically referred to as a “Recession Agreement”, which purports to require you to return the car if the bank refuses to honor the contract as written. There are financial penalties if you don’t. This was common practice with all Florida car dealers for many years but court decisions, case law, has made this a very questionable practice. I hope that this never happens to you but if it does and you decide you want to keep the car under the terms of the original finance contract, I recommend you hire a lawyer.

Monday, November 10, 2014

The Dealer Fee Deception Grows...

Recently, I sent a mystery shopper into a Kia dealership in West Palm Beach. Her assignment was to respond to TV, radio, and Internet advertisements to buy a new Kia Soul for $179 per month or “less than $6 per day”.

We give our mystery shoppers code names to protect their real identities because most car dealerships listen to my weekly radio show. This shopper’s code name is “Agent K”. Agent K told the sales person who greeted her that she was responding to the advertisement for a new Kia Soul for only $179 per month. The salesman led her over and showed her the advertised car and as they walked over to the car he said “the advertising for this car is not all true”. Interestingly, a comment like this from car salespeople is not unusual. The sales people don’t write the advertisements and are not responsible for the sales tactics of the dealership they work for. Many are apologetic and do not like to have to explain unfair and deceptive advertisements to their customers. They are the ones that have to face angry customers when they find out that the advertisements aren’t true. Jobs are hard to come by these days and I can almost understand why someone might compromise their ethics to put food on their family’s table.

The salesman explained that the advertised car was a stick shift. He also explained that she would have to make a cash down payment of $4,000 and make monthly payments for the next six years and three months. Furthermore, she would have to have a credit Beacon score of at least 750 to qualify for the 2.79% interest rate they used to calculate the low payment.

The salesman asked Agent K if she would like to take a demonstration ride in the new Kia Soul but she responded “no” because she had already test driven one at another dealer. She didn’t tell him the real reason she wouldn’t test drive it was because she didn’t know how to drive a stick shift. Of course, this is the exact reason that car dealers advertise cars that don’t have automatic transmissions because 99% of car buyers don’t want to buy a stick shift and most have never driven one.

Another thing that the car salesman did not tell Agent K was that there was only one car available at the advertised price. This was not clearly disclosed in the advertisements but indicated only in the very fine print by a “stock number”. The stock number for this bait and switch car was 130940 which is probably the last six digits of the VIN. The only way I was able to view this number was by looking on the Internet ad, printing it out, and then using a magnifying glass to read it. It is literally impossible to read the fine print on the TV advertisements and impossible to hear the disclosure on the radio advertisements. The fine print on TV appears only for a second or two as a blur on the bottom of the screen and the radio audio disclosure is deliberately obfuscated by speeding up the sound track and lowering the volume.

The reason that car dealers use a stock number in the fine print is so that they can abide by the Florida law that requires that the dealer fee be included in all “advertised” prices. This anemic law resulted from the powerful lobbying of the Florida Automobile Dealers Association, FADA. This means that a salesman can quote you a price on new car in person, on the phone or via email without disclosing that there is an extra charge (without limit!) that he can legally add after you have agreed to buy the car. A car dealer must only tell the truth about the full price of his cars when he advertises that specific car.

The Kia dealer in West Palm Beach has three dealer fees totaling $971.45. He doesn’t name any of them “dealer fee”. Florida law allows dealers to name this extra, hidden profit anything they choose. This just makes it easier for the car dealers to hide this hidden profit from their customers. The Kia dealer decided to name one of his dealer fees “delivery fee” and it is $699.95. He probably chose this to make the customer believe that this was for inspecting, washing, and adjusting the new car. What most customers don’t know is that these costs are actually paid for by the manufacturer. His second dealer fee he chose to name “document and handling fee” and in the fine print on his buyer’s order says it’s “preparation, processing and handling of the documents required in registration, filing and licensing of the vehicle” and this extra profit to him is $218.55. This West Palm Beach Kia dealer does have expenses for processing and handling documents. He also has expenses for his monthly utility bills, sales commissions, and lease payments for his building, not to mention his deceptive advertising. But businesses are supposed to include all of their expenses in the prices of the products they sell. They are not supposed to tell you the price and then make you pay their expenses on top of that price. The third dealer fee this Kia dealer chose to name Electronic Filing/Private Tag Agency Fee which amounts to $64.95. He does pay a company to process his tag work but he doesn’t pay them $64.95. It’s $10 or $15 and then he marks it up and adds this to his profits.

You’ll notice that all of the dealer fee names have something in common. They all end in “fee”. This is by design because the word fee has an official sounding sound about it. This is to lead you to believe that all of these fees are federal, state, or local taxes or fees. One way to detect real fees from additional profit to the dealer is by whether or not the dealer charges you sales tax on that amount. He is required by law to pay Florida sales tax on the full, true selling price of the vehicle which must include his all of his profit and expenses except for tax and tag.

Just as an aside, I’ll also mention that this dealer marks up the manufacturer’s suggested retail price, MSRP, sticker on all of his cars by $2,999. He places this addendum label next to the official Monroney sticker and calls the extra markup “Regional Market Value Adjustment”. This is actually reduction from a few months ago when his “Regional Market Value Adjustment” was $6,999! Dealers do this so that they can offer inflated discounts and trade-in allowances. This practice is clearly in violation of spirit and intent of the federal law mandating that a Monroney label be placed on every new car to afford buyers a common basis for comparing prices.

I hope Pam Bondi, Florida’s recently reelected Attorney General, reads this article. I think I know how she would feel if a relative or friend of hers were victimized by this dealer or one of the other Florida car dealers, most of whom use the dealer fee and the “phony Monroney” to overcharge their customers. Maybe she would join me in mystery shopping some car dealers to learn how Florida car buyers are being victimized and then do something about it.

We give our mystery shoppers code names to protect their real identities because most car dealerships listen to my weekly radio show. This shopper’s code name is “Agent K”. Agent K told the sales person who greeted her that she was responding to the advertisement for a new Kia Soul for only $179 per month. The salesman led her over and showed her the advertised car and as they walked over to the car he said “the advertising for this car is not all true”. Interestingly, a comment like this from car salespeople is not unusual. The sales people don’t write the advertisements and are not responsible for the sales tactics of the dealership they work for. Many are apologetic and do not like to have to explain unfair and deceptive advertisements to their customers. They are the ones that have to face angry customers when they find out that the advertisements aren’t true. Jobs are hard to come by these days and I can almost understand why someone might compromise their ethics to put food on their family’s table.

The salesman explained that the advertised car was a stick shift. He also explained that she would have to make a cash down payment of $4,000 and make monthly payments for the next six years and three months. Furthermore, she would have to have a credit Beacon score of at least 750 to qualify for the 2.79% interest rate they used to calculate the low payment.

The salesman asked Agent K if she would like to take a demonstration ride in the new Kia Soul but she responded “no” because she had already test driven one at another dealer. She didn’t tell him the real reason she wouldn’t test drive it was because she didn’t know how to drive a stick shift. Of course, this is the exact reason that car dealers advertise cars that don’t have automatic transmissions because 99% of car buyers don’t want to buy a stick shift and most have never driven one.

Another thing that the car salesman did not tell Agent K was that there was only one car available at the advertised price. This was not clearly disclosed in the advertisements but indicated only in the very fine print by a “stock number”. The stock number for this bait and switch car was 130940 which is probably the last six digits of the VIN. The only way I was able to view this number was by looking on the Internet ad, printing it out, and then using a magnifying glass to read it. It is literally impossible to read the fine print on the TV advertisements and impossible to hear the disclosure on the radio advertisements. The fine print on TV appears only for a second or two as a blur on the bottom of the screen and the radio audio disclosure is deliberately obfuscated by speeding up the sound track and lowering the volume.

The reason that car dealers use a stock number in the fine print is so that they can abide by the Florida law that requires that the dealer fee be included in all “advertised” prices. This anemic law resulted from the powerful lobbying of the Florida Automobile Dealers Association, FADA. This means that a salesman can quote you a price on new car in person, on the phone or via email without disclosing that there is an extra charge (without limit!) that he can legally add after you have agreed to buy the car. A car dealer must only tell the truth about the full price of his cars when he advertises that specific car.

The Kia dealer in West Palm Beach has three dealer fees totaling $971.45. He doesn’t name any of them “dealer fee”. Florida law allows dealers to name this extra, hidden profit anything they choose. This just makes it easier for the car dealers to hide this hidden profit from their customers. The Kia dealer decided to name one of his dealer fees “delivery fee” and it is $699.95. He probably chose this to make the customer believe that this was for inspecting, washing, and adjusting the new car. What most customers don’t know is that these costs are actually paid for by the manufacturer. His second dealer fee he chose to name “document and handling fee” and in the fine print on his buyer’s order says it’s “preparation, processing and handling of the documents required in registration, filing and licensing of the vehicle” and this extra profit to him is $218.55. This West Palm Beach Kia dealer does have expenses for processing and handling documents. He also has expenses for his monthly utility bills, sales commissions, and lease payments for his building, not to mention his deceptive advertising. But businesses are supposed to include all of their expenses in the prices of the products they sell. They are not supposed to tell you the price and then make you pay their expenses on top of that price. The third dealer fee this Kia dealer chose to name Electronic Filing/Private Tag Agency Fee which amounts to $64.95. He does pay a company to process his tag work but he doesn’t pay them $64.95. It’s $10 or $15 and then he marks it up and adds this to his profits.

You’ll notice that all of the dealer fee names have something in common. They all end in “fee”. This is by design because the word fee has an official sounding sound about it. This is to lead you to believe that all of these fees are federal, state, or local taxes or fees. One way to detect real fees from additional profit to the dealer is by whether or not the dealer charges you sales tax on that amount. He is required by law to pay Florida sales tax on the full, true selling price of the vehicle which must include his all of his profit and expenses except for tax and tag.

Just as an aside, I’ll also mention that this dealer marks up the manufacturer’s suggested retail price, MSRP, sticker on all of his cars by $2,999. He places this addendum label next to the official Monroney sticker and calls the extra markup “Regional Market Value Adjustment”. This is actually reduction from a few months ago when his “Regional Market Value Adjustment” was $6,999! Dealers do this so that they can offer inflated discounts and trade-in allowances. This practice is clearly in violation of spirit and intent of the federal law mandating that a Monroney label be placed on every new car to afford buyers a common basis for comparing prices.

I hope Pam Bondi, Florida’s recently reelected Attorney General, reads this article. I think I know how she would feel if a relative or friend of hers were victimized by this dealer or one of the other Florida car dealers, most of whom use the dealer fee and the “phony Monroney” to overcharge their customers. Maybe she would join me in mystery shopping some car dealers to learn how Florida car buyers are being victimized and then do something about it.

Monday, November 03, 2014

Understanding Your New Car Warranty

When you buy your new car your salesman will tell you that it has a “bumper to bumper” warranty. The most common coverage is for 3 years or 36,000 miles whichever should first occur. “Bumper to bumper” warranty sounds like it means that everything is covered. Unfortunately this is not the case. For example, your tires are not covered at all by the car manufacturer but under a separate warranty by the tire manufacturer.

It can be tedious, but the only way to completely understand your warranty is to actually read it. All warranties now are required to use the word “limited” unless there are absolutely zero exclusions and this, to the best of my knowledge, is never the case.

Some of the most common items that are mistakenly believed to be included in warranties are tires, rental car coverage, maintenance, and faded or damaged paint from various kinds of air contaminants.

I don’t know why all car manufacturers choose to exclude tires from their “bumper to bumper” warranties. After all, they choose the tire manufacturer just like they choose the manufacturer of other components on your car which they don’t manufacture themselves like the sound systems. The owner of a car has an established relationship with the service department of the dealership because she is bringing her car back every 5,000 miles or so for factory recommended maintenance. In most cases, she doesn’t even know who the tire dealer is. It would be far more customer friendly for the manufacturer to allow her dealer to handle warranty claims on tires. My suggestion is to ask your dealer’s service advisor or service manager to “broker” the warranty claim on your tires on your behalf. The dealership is more likely to have an established relation ship with a tire store and they can be your advocate.

New car warranties virtually never provide for a free rental car unless the vehicle must be tied up overnight for repairs. All too often, car salesman will promise you a “free loaner” anytime your car is in for service. Verify this with the service department before you rely upon it. There are extended service contracts which you can buy in addition to your new car warranty which will provide rental car coverage.

A new car warranty covers only “repairs” not maintenance items. A very common request is that a front end alignment be performed under warranty. Your alignment should have been checked before your car was delivered. If your car goes out of alignment after delivery, it is usually considered owner’s maintenance. Brakes are another item often misunderstood as being covered under warranty. Brake wear is almost always a maintenance item. Only a mechanical defect in your brakes is covered under warranty.

It can be tedious, but the only way to completely understand your warranty is to actually read it. All warranties now are required to use the word “limited” unless there are absolutely zero exclusions and this, to the best of my knowledge, is never the case.

Some of the most common items that are mistakenly believed to be included in warranties are tires, rental car coverage, maintenance, and faded or damaged paint from various kinds of air contaminants.

I don’t know why all car manufacturers choose to exclude tires from their “bumper to bumper” warranties. After all, they choose the tire manufacturer just like they choose the manufacturer of other components on your car which they don’t manufacture themselves like the sound systems. The owner of a car has an established relationship with the service department of the dealership because she is bringing her car back every 5,000 miles or so for factory recommended maintenance. In most cases, she doesn’t even know who the tire dealer is. It would be far more customer friendly for the manufacturer to allow her dealer to handle warranty claims on tires. My suggestion is to ask your dealer’s service advisor or service manager to “broker” the warranty claim on your tires on your behalf. The dealership is more likely to have an established relation ship with a tire store and they can be your advocate.

New car warranties virtually never provide for a free rental car unless the vehicle must be tied up overnight for repairs. All too often, car salesman will promise you a “free loaner” anytime your car is in for service. Verify this with the service department before you rely upon it. There are extended service contracts which you can buy in addition to your new car warranty which will provide rental car coverage.

A new car warranty covers only “repairs” not maintenance items. A very common request is that a front end alignment be performed under warranty. Your alignment should have been checked before your car was delivered. If your car goes out of alignment after delivery, it is usually considered owner’s maintenance. Brakes are another item often misunderstood as being covered under warranty. Brake wear is almost always a maintenance item. Only a mechanical defect in your brakes is covered under warranty.

Monday, October 27, 2014

10 EARLY NEW YEAR’S RESOLUTIONS FOR FLORIDA CAR DEALERS

With just two months left in 2014, I’m suggesting these New Year’s resolutions for Florida's car dealers; I want them to have enough time to get their acts together ;)

1. Stop charging your dealer fee (a. k. a. delivery fee and doc fee). This fee is really profit for the dealer disguised as an official fee charged by the state or federal government. When you quote a customer a price, it should include all charges except for sales tax and license fees. State law in Florida does not prohibit this or even put a cap on this fee as many other states now do, but it’s just the wrong thing to do.

2. When you advertise a car at a price, clearly disclose to the reader how many cars are available at that price. Dealers get around the law by listing a stock number next to the car, as if this is will explain to the reader of the ad that there is only one available at this price.

3. Don’t advertise a large discount on a car unless the discount is from MSRP. Dealers advertise huge discounts from prices that are artificially inflated. What good is a $15,000 discount if the dealer has a $15,000 markup above MSRP on that car?

4. Don’t pander to folks with bad credit and give them false hope. Tell those with bad credit that if their credit is too bad, you cannot obtain financing for them. When you advertise…”No credit or Bad Credit is No Problem” you aren’t telling the truth. When you advertise that “no credit application is refused”, you are misleading the customers to think that no loan is refused because of bad credit. You are not telling them the truth.

5. Don’t advertise that you can sell used cars as low as $99. There is no such thing as used car that can be profitably sold for $99. The scrap metal or the parts on a car that cannot run or is totaled in an accident is worth $150 or more.

6. Have a heart! I received a call this morning from the son of an 81 year old man who had been diagnosed with bipolar disorder and committed to a mental health institution under the Baker Act. The day before he was committed, his father bought a brand new car for $32,000+ from a well-known South Florida dealer. The son read my column instructing those with a problem with a car dealer to call the owner or the general manager before taking legal action or notifying the press. When he tried this, he was stonewalled by both the general manager and the president of the dealership. His father had bought the car the day before he was committed to an institution under the Baker Act. This is not only heartless but just plain stupid. What do you think this will do for that dealer’s reputation when their customer’s son contacts the local TV stations and newspaper?

7. Be accessible to your customers. You might think that you own and operate a pristine business that never offends or takes advantage of anyone, but you can’t be sure about that if you insulate yourself from your customers. You might be amazed at what you find out when you speak directly to your customers and even to those who wanted to be your customer but changed their mind for some reason.

8. Don’t surprise your service customers with a “miscellaneous supplies fee”. Sometimes this is called an “environmental fee”. The price you quote your service customers should be the price they pay…not that price plus 10% which is pure profit to the dealer.

9. Don’t mark up your “hot models” over MSRP. The manufacturer’s suggest retail price affords the dealer very generous profit margin. Don’t exploit the temporary situation where demand for that hot model exceeds supply. This is no different than some gas station operators do during fuel shortages before and after hurricanes.

10. Do away with the fine print. If there is something important that is worth reading in your ad, print it in a font size that can be read without a magnifying glass. If it’ not important, don’t put it in the ad. The only reason for fine print in a car ad is to hide something that you don’t want the reader to find.

1. Stop charging your dealer fee (a. k. a. delivery fee and doc fee). This fee is really profit for the dealer disguised as an official fee charged by the state or federal government. When you quote a customer a price, it should include all charges except for sales tax and license fees. State law in Florida does not prohibit this or even put a cap on this fee as many other states now do, but it’s just the wrong thing to do.

2. When you advertise a car at a price, clearly disclose to the reader how many cars are available at that price. Dealers get around the law by listing a stock number next to the car, as if this is will explain to the reader of the ad that there is only one available at this price.

3. Don’t advertise a large discount on a car unless the discount is from MSRP. Dealers advertise huge discounts from prices that are artificially inflated. What good is a $15,000 discount if the dealer has a $15,000 markup above MSRP on that car?

4. Don’t pander to folks with bad credit and give them false hope. Tell those with bad credit that if their credit is too bad, you cannot obtain financing for them. When you advertise…”No credit or Bad Credit is No Problem” you aren’t telling the truth. When you advertise that “no credit application is refused”, you are misleading the customers to think that no loan is refused because of bad credit. You are not telling them the truth.

5. Don’t advertise that you can sell used cars as low as $99. There is no such thing as used car that can be profitably sold for $99. The scrap metal or the parts on a car that cannot run or is totaled in an accident is worth $150 or more.

6. Have a heart! I received a call this morning from the son of an 81 year old man who had been diagnosed with bipolar disorder and committed to a mental health institution under the Baker Act. The day before he was committed, his father bought a brand new car for $32,000+ from a well-known South Florida dealer. The son read my column instructing those with a problem with a car dealer to call the owner or the general manager before taking legal action or notifying the press. When he tried this, he was stonewalled by both the general manager and the president of the dealership. His father had bought the car the day before he was committed to an institution under the Baker Act. This is not only heartless but just plain stupid. What do you think this will do for that dealer’s reputation when their customer’s son contacts the local TV stations and newspaper?

7. Be accessible to your customers. You might think that you own and operate a pristine business that never offends or takes advantage of anyone, but you can’t be sure about that if you insulate yourself from your customers. You might be amazed at what you find out when you speak directly to your customers and even to those who wanted to be your customer but changed their mind for some reason.

8. Don’t surprise your service customers with a “miscellaneous supplies fee”. Sometimes this is called an “environmental fee”. The price you quote your service customers should be the price they pay…not that price plus 10% which is pure profit to the dealer.

9. Don’t mark up your “hot models” over MSRP. The manufacturer’s suggest retail price affords the dealer very generous profit margin. Don’t exploit the temporary situation where demand for that hot model exceeds supply. This is no different than some gas station operators do during fuel shortages before and after hurricanes.

10. Do away with the fine print. If there is something important that is worth reading in your ad, print it in a font size that can be read without a magnifying glass. If it’ not important, don’t put it in the ad. The only reason for fine print in a car ad is to hide something that you don’t want the reader to find.

Monday, October 20, 2014

Why Your Car Dealership Won’t Tell You the Price

I’m sure that you noticed that the last time you went car shopping you were unable to get a firm price on the car, unless you were willing to sign on the dotted line and put down a deposit. It’s impossible to get a firm price on a car over the telephone, and very difficult to get one via email. If on the off chance you’ve never bought a car, or haven’t bought one in a long time, try this. Call any car dealership and ask for a price on a specific year, make, and model. I can almost guarantee that you won’t be able to get a firm price.

Have you ever wondered why you can get a firm price on just about any other product except an automobile? You can call a jewelry store and get a price on a diamond ring that costs as much or more than a car. You can go on Amazon.com, get a firm price, and buy virtually anything. Walk in or call any department store and they give you a firm, out-the-door price.

Car dealers don’t want to give you a firm price because they want to deprive you of your rights in our American free-market economy. One of our important American freedoms is to be able to shop and compare prices so that you can choose the best one. There are some countries where the prices are dictated by the government or giant cartels. We have anti-trust laws in America that prohibit price fixing, monopolies, or collusion between companies which keep prices artificially high.

In fact, there’s even a federal law that says auto manufacturers must put a sticker on all vehicles that discloses the Manufacturer’s Suggested Retail Price, MSRP. This law was written by Senator Mike Monroney back in 1958. Senator Monroney felt there was a need for this law because, before then, car dealers could ask any price they wanted for car. They could put their own price sticker on their cars and mark their cost up any amount they chose. A car-buyer, pre 1958, had absolutely no basis for comparing prices between competing car dealers. The MSRP gave every car shopper a common basis for comparing discounts from MSRP. All dealers pay their manufacturers the same price for a car and all MSRP’s for a specific year-make-model have the same percentage markup. The Monroney label was a great idea and it worked fairly well for a while, but it wasn’t too long before the car dealers figured out ways around this “handicap” to their profit margins.

The easiest way around an MSRP is simply to refuse to give the customer a firm discount unless they agree to buy the car, and this is why you can’t get a price from a car dealer until then. Another way is to give you a firm discount but add hidden charges like dealer fees, doc fees, electronic filing fees, or dealer installed accessories after you agree on the discount from MSRP. “Bait and switch” is a popular tactic which simply brings you in to buy a specific car only to find out that its “just been sold”…but here’s another one almost like it. Another popular tactic is to advertise discounts from “list price”, “dealer list price”, or “sticker price”. Dealers even have counterfeit Monroney labels printed that they display alongside of the real Monroney label. These counterfeit price stickers I’ve named “Phony Monroney’s”. I’ve seen advertisements from Napleton Chrysle-Jeep-Dodge in North Palm Beach last Saturday, advertising “$10,500 Discounts on Every Vehicle in Stock”. The discounts aren’t from the MSRP but from “dealer list” which is clearly thousands of dollars above MSRP.

The best defense against all of this is to insist on an out-the-door price. Explain the following to the sales manager at the car dealership. “If you give me an honest out-the-door price, I will compare it with the two prices I already have from two other car dealerships. I will buy from the dealer with the lowest price. If you agree to give me your best price, you have a 33% chance of selling me a car. If you refuse to give me a price right now, you have 0% chance of selling me a car, because I will walk out that front door and you will never see me or hear from me again.” You can accomplish the same thing over the telephone or via email.

I also recommend that you try www.TrueCar.com in addition to the tactic I just described. By way of full disclosure, I’m a TrueCar dealer, I own stock in TrueCar, and I’m a member of the TrueCar national dealer council. If you give TrueCar a try, be sure to navigate to the page on their website that gives you the final price certificate. Do not rely on the estimated TrueCar prices on the previous page. To get the TrueCar certificate you must enter a name, email address, and phone number. If you would rather not be contacted by a car salesman, enter a different phone number and name. You can even get a different free email address from Yahoo, Microsoft, or Google. The TrueCar dealers are required to give you an out-the-door price on their price certificate (plus only government fees like license, sales tax, and registration). This means they should disclose all dealer fees and dealer-installed options. If they do not do this, you can call TrueCar on a toll free number:

"Total Transparency Pledge: As a TrueCar Certified Dealer, this car dealer is committed to total price transparency. This means that this car dealer discloses its dealer fees and commonly installed dealer accessories in its pricing estimates. Call 1-888-TRUECAR if you have questions or concerns.”

Have you ever wondered why you can get a firm price on just about any other product except an automobile? You can call a jewelry store and get a price on a diamond ring that costs as much or more than a car. You can go on Amazon.com, get a firm price, and buy virtually anything. Walk in or call any department store and they give you a firm, out-the-door price.

Car dealers don’t want to give you a firm price because they want to deprive you of your rights in our American free-market economy. One of our important American freedoms is to be able to shop and compare prices so that you can choose the best one. There are some countries where the prices are dictated by the government or giant cartels. We have anti-trust laws in America that prohibit price fixing, monopolies, or collusion between companies which keep prices artificially high.

In fact, there’s even a federal law that says auto manufacturers must put a sticker on all vehicles that discloses the Manufacturer’s Suggested Retail Price, MSRP. This law was written by Senator Mike Monroney back in 1958. Senator Monroney felt there was a need for this law because, before then, car dealers could ask any price they wanted for car. They could put their own price sticker on their cars and mark their cost up any amount they chose. A car-buyer, pre 1958, had absolutely no basis for comparing prices between competing car dealers. The MSRP gave every car shopper a common basis for comparing discounts from MSRP. All dealers pay their manufacturers the same price for a car and all MSRP’s for a specific year-make-model have the same percentage markup. The Monroney label was a great idea and it worked fairly well for a while, but it wasn’t too long before the car dealers figured out ways around this “handicap” to their profit margins.

The easiest way around an MSRP is simply to refuse to give the customer a firm discount unless they agree to buy the car, and this is why you can’t get a price from a car dealer until then. Another way is to give you a firm discount but add hidden charges like dealer fees, doc fees, electronic filing fees, or dealer installed accessories after you agree on the discount from MSRP. “Bait and switch” is a popular tactic which simply brings you in to buy a specific car only to find out that its “just been sold”…but here’s another one almost like it. Another popular tactic is to advertise discounts from “list price”, “dealer list price”, or “sticker price”. Dealers even have counterfeit Monroney labels printed that they display alongside of the real Monroney label. These counterfeit price stickers I’ve named “Phony Monroney’s”. I’ve seen advertisements from Napleton Chrysle-Jeep-Dodge in North Palm Beach last Saturday, advertising “$10,500 Discounts on Every Vehicle in Stock”. The discounts aren’t from the MSRP but from “dealer list” which is clearly thousands of dollars above MSRP.

The best defense against all of this is to insist on an out-the-door price. Explain the following to the sales manager at the car dealership. “If you give me an honest out-the-door price, I will compare it with the two prices I already have from two other car dealerships. I will buy from the dealer with the lowest price. If you agree to give me your best price, you have a 33% chance of selling me a car. If you refuse to give me a price right now, you have 0% chance of selling me a car, because I will walk out that front door and you will never see me or hear from me again.” You can accomplish the same thing over the telephone or via email.

I also recommend that you try www.TrueCar.com in addition to the tactic I just described. By way of full disclosure, I’m a TrueCar dealer, I own stock in TrueCar, and I’m a member of the TrueCar national dealer council. If you give TrueCar a try, be sure to navigate to the page on their website that gives you the final price certificate. Do not rely on the estimated TrueCar prices on the previous page. To get the TrueCar certificate you must enter a name, email address, and phone number. If you would rather not be contacted by a car salesman, enter a different phone number and name. You can even get a different free email address from Yahoo, Microsoft, or Google. The TrueCar dealers are required to give you an out-the-door price on their price certificate (plus only government fees like license, sales tax, and registration). This means they should disclose all dealer fees and dealer-installed options. If they do not do this, you can call TrueCar on a toll free number:

"Total Transparency Pledge: As a TrueCar Certified Dealer, this car dealer is committed to total price transparency. This means that this car dealer discloses its dealer fees and commonly installed dealer accessories in its pricing estimates. Call 1-888-TRUECAR if you have questions or concerns.”

Monday, October 13, 2014

Leasing a Car Can be Hazardous to your (Financial) Health

I recently received an email from a very smart man and a reader of this column who was recently victimized by a car dealer when he leased a Mazda. The dealer had added a second dealer fee, calling it an “electronic filing fee” into the capitalized cost of the lease. He found this particular dealer through TrueCar, a vehicle purchasing referral service that I’ve recommended in this column. In full disclosure, I’m a member of TrueCar’s national dealer council and a stockholder.

This man’s experience reminded me of the fact that leasing is far more complicated than buying a car. It also reminded me of the old saying, “If you sit down at a high stakes poker game, look around the table and can’t find the ‘sucker’, then you’re it.” When you walk into a car dealership (high stakes poker game) you can be sure that the salesman, sales manager, and F&I manager all know far more about leasing than you do. I’m not suggesting that you shouldn’t lease a car because sometimes leasing can be better than buying; but buying is easier to understand and therefore you’re less likely to be taken advantage of.

I’m going to assume that you understand how to buy a car. I recommend that you determine the exact year-make-model vehicle you want and determine the exact MSRP, manufacturer’s recommended retail price. Once you’ve done this, get at least 3 bid from three dealers. This is best and most easily accomplished using the Internet. I also recommend that you use www.TrueCar.com. Unfortunately, TrueCar currently gives only an estimated lease payment but will shortly be making available a firm one. When using TrueCar for a purchase price, be sure that you go beyond the TrueCar lowest price estimate page and view the True Car Buying Certificate. The estimate page does not disclose additional dealer fees, dealer installed accessories, or anything else the dealer will be adding to his “TrueCar price”. You can see these extras when you go on to the page that shows you the TrueCar buying Certificate. But even then, you must be careful when you visit the dealer who appears to have the lowest price or payment. This is how the “very smart man” that I mentioned in the first paragraph was tricked. He did get the final price including dealer fees, but the dealer lied to him and added another fee disguised as an official fee. The dealer called this an “electronic filing fee”, yet it was just another dealer fee in disguise.

It’s important to mention here that I fear that some buyers hesitate to navigate to the TrueCar page with the price certificate because doing so requires revealing one’s identity and contact information to the dealer. However, if you want to maintain your anonymity, you can always use an alias, make up a phone number, and create a different email address.